Another month, another crypto IPO. Yesterday, it was the institutional-focused crypto exchange Bullish that rang the opening bell at the NYSE. And investors liked it.

The stock more than tripled within minutes of listing and closed 84% above its IPO price at $68.

Bullish counts more than 1,000 institutions among its clients, and if IPO performance is any proxy for investor sentiment these days, Wall Street appears bullish (pun very much intended) on the outlook for institutional crypto adoption.

Today, we’ll also talk about:

S&P Global issues first-ever credit rating for a DeFi protocol

Exclusive: Circle’s dual-issuance model faces ongoing oversight in Europe

Canton enables weekend U.S. Treasury repo in real-time

HIGH SIGNAL NEWS

ICE connects FX and metals data to blockchain via Chainlink. NYSE parent ICE is making its FX and precious metals rates from the ICE Consolidated Feed available for web3 uses, enabling market data for multi-currency stablecoins, tokenized gold, and onchain derivatives.🇺🇸

BBVA offers off-exchange custody for Binance. Spanish bank BBVA is holding US Treasuries and crypto assets for Binance clients outside the exchange to reduce counterparty risk, the FT reports.🏦

JP Morgan, HQLAᵡ and Ownera connect DLT platforms for intraday repo. JP Morgan’s Kinexys accounts can now settle intraday repos with collateral on HQLAᵡ via Ownera’s FinP2P, enabling near-instant transfers between separate DLTs.⛓

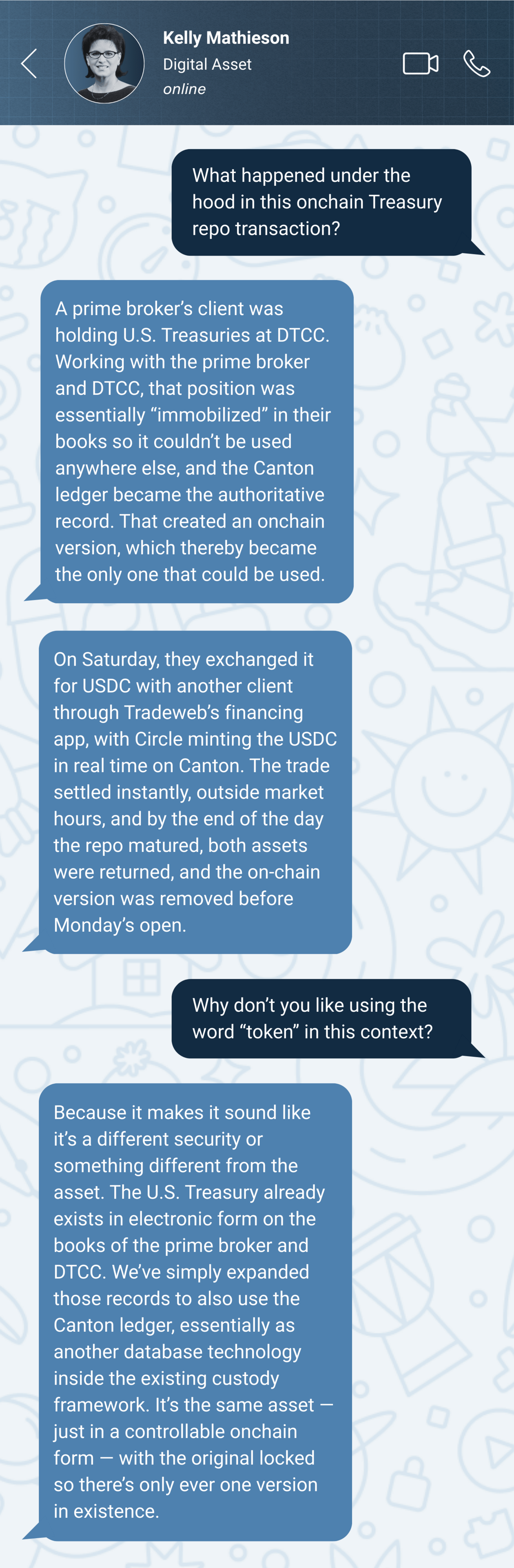

Canton enables weekend U.S. Treasury repo in real-time. A working group of institutions used Digital Asset’s Canton Network and Tradeweb to exchange onchain U.S. Treasuries held at DTCC for USDC, achieving atomic settlement outside traditional market hours. Scroll down for our Proof-of-Talk with Kelly Mathieson, Chief Business Officer at Digital Asset.💬

Standard Chartered, HKT, and Animoca launch a stablecoin joint venture. Named Anchorpoint, it will seek a license under Hong Kong’s new regulatory regime.🪙

DECENTRALIZED FINANCE

S&P Issues First-Ever Credit Rating for a DeFi Protocol

Rating debut: On August 7, S&P Global Ratings issued its first-ever credit rating for a decentralized finance (DeFi) protocol, assigning Sky Protocol — formerly MakerDAO — a B-. The assessment used S&P’s global scale, placing Sky’s risk profile alongside that of traditional lenders worldwide rather than under a bespoke DeFi framework.

“Sky Protocol approached us to assign a credit rating on our global scale,” Andrew O’Neill, Managing Director and Analytical Lead for Digital Assets at S&P Global, told Blockstories. “We felt it was important to benchmark Sky against global peers. That gives market participants a common frame of reference.”

About Sky Protocol: Operating on Ethereum, Sky is one of the largest decentralized lending platforms and the issuer of the USDS and DAI stablecoins. It offers crypto-collateralized loans in USDS and a savings product for USDS holders to earn yield, making it the fourth-largest stablecoin issuer globally.

Early bridge into TradFi: Sky has also been an early mover in integrating real-world assets (RWAs) into DeFi reserves to diversify collateral and boost yields. In October 2022, it began allocating a significant share of DAI reserves to U.S. Treasuries and other RWAs. By March 2025, it had invested in BlackRock’s BUIDL fund and Janus Henderson’s tokenized Anemoy Treasury Fund via Centrifuge, the latter also carrying an S&P rating.

A traditional-style rating: Applying the same methodology used for banks and corporates, S&P assessed Sky much like any other lender — focusing on the ability to meet obligations, resilience under stress, and adequacy of risk management. “It is a lender where the key risks include potential losses on assets, the risk of a liquidity run, insufficient capital to cover losses, and failures in risk management, all of which are conceptually very comparable to those faced by a traditional lender,” said O’Neill.

Why the B-: The speculative-grade rating reflects both market-wide uncertainties and protocol-specific weaknesses.

Capital strength: A limited capital base that will take time, profitability, and retained earnings to strengthen.

Depositor concentration: Reliance on a small number of large depositors, heightening liquidity risk in the event of sudden withdrawals.

Governance structure: Centralized decision-making and key-person risk around founder Rune Christensen, plus the potential for strategic disruption from dissident voters.

Regulatory clarity: Uncertainty around DAO governance and DeFi–TradFi interaction, with meaningful clarity likely years away.

Looking ahead: For S&P, the Sky case may serve as a blueprint for rating other protocols where traditional risk concepts map cleanly, such as lending platforms. “I can’t comment on the specific pipeline, but the DeFi market is increasingly looking to integrate with TradFi participants, and we see a role for ourselves in facilitating well-informed risk discussions,” O’Neill said.

→ In our full interview, we also spoke with Andrew O’Neill about S&P’s stablecoin stability assessments, the distinct challenges of rating DeFi protocols, and how tokenization fits into the agency’s broader strategy.

Moorad Choudhry is a seasoned risk and finance professional with a deep bank treasury and Asset-Liability Committee experience. He currently contributes to the Sky Digital ALCO process as an independent ecosystem advisor.

In traditional finance, a public credit rating signals that an entity has undergone an independent, objective and thorough review of its risk management and governance. It tells the market that the firm takes balance sheet discipline seriously. Sky’s willingness to go through this process sends a strong signal.

Participating in the process was also a personal goal to help bridge the gap between the two worlds and increase understanding on both sides. The exercise surfaced persistent biases, such as treating USDC as far riskier than Treasuries or penalising overcollateralised ETH or BTC backed loans more heavily than investment grade corporate bonds, even though their liquidity is often greater.

Over time, shared language and better awareness of DeFi’s strengths, such as real time transparency into balance sheet flows and asset returns, can narrow this gap. In traditional banking, similar updates can take days or even weeks.

STABLECOINS

Exclusive: Circle’s Dual-Issuance Model Faces Ongoing Oversight in Europe

Regulatory spotlight: On July 1, 2024, Circle became the first to secure a MiCA license for issuing a stablecoin under the dual issuance model, preserving USDC’s fungibility through two entities, one in the U.S. and one in Europe. More than a year on, our investigations reveal that questions still surround how reserves are rebalanced between the two, with the ACPR, France’s banking regulator, maintaining close oversight of the model.

Why it matters: Under MiCA, large stablecoin issuers must keep at least 60% of reserves in EU bank deposits to guarantee local redemptions if the global entity encounters trouble. For Circle, that requirement shifts a significant portion of USDC’s backing from higher-yield U.S. Treasuries to low-yield European accounts, squeezing margins. While the dual-issuance model preserves USDC’s global fungibility, it also adds complexity to reserve tracking and cross-border rebalancing — a key concern for regulators.

A European USDC? This complexity is why regulators considered forcing Circle to issue a separate “European USDC” during the listing process.

“Fortunately for Circle, it was not adopted. Otherwise it would have fragmented the stablecoin’s liquidity,” a source close to the matter told Blockstories.

Close monitoring with the ACPR: The main challenge is knowing exactly how many units of USDC are held by EU users, especially given the peer-to-peer nature of DeFi and self-custody. This was one of the main reasons why Circle initially obtained a “conditional” license from the ACPR, pending an assessment of the robustness of the model implemented by the company.

The current solution: To address these concerns, a source familiar with the matter outlined how Circle tracks and manages its European exposure in an effort to improve accuracy:

CASP data: Circle receives daily information on USDC holdings in the EU from major regulated exchanges, in line with MICAR obligations.

B2B clients via Circle France: Any European entity wishing to mint or burn USDC must go through Circle France, providing real-time visibility on their positions.

Non-custodial estimation: An internal process, developed with the ACPR, estimates the European holdings of self-custodial wallets using internal data, geographic indicators, and proxy metrics, without absolute precision.

Automated reserve management: These data points feed into a target reserve calculation for Europe. If actual reserves deviate — for example, if USDC is redeemed in Europe after being minted in the U.S. — an automated process moves funds between the global and EU reserves. Since August 2024, both entities have had access to the Circle Reserve Fund managed by BlackRock, holding the cash and short-term U.S. Treasuries backing USDC, simplifying cross-border transfers.

Safeguards and cooperation: In addition to these practices, the French regulator made several safeguard requests, such as increasing the capital of Circle’s French entity, which the issuer accepted, according to our information.

“For now, Circle’s license is absolutely not under threat. The issuer has been fully cooperative, and reporting is closely monitored,” two sources close to the matter said.

A growing standard: Circle is not alone in adopting this structure. Last month, Paxos became a regulated issuer in Europe with its Global Dollar Network (GUSD), backed by Kraken and Robinhood, using a similar approach.

“From the very first MiCAR negotiations, it has always been widely shared among legislators that this dual issuance model would become a global standard,” an EU official told us.

Looking ahead: The challenge could intensify as more jurisdictions introduce reserve localisation rules, potentially forcing issuers to replicate this framework in multiple regions. “The more countries that demand local reserves, the more important accurate, real-time accounting becomes for investor protection,” one regulatory source noted.

Bybit: Banking & Payments Relationship Manager, Wien 🇦🇹

Deka: Digital Assets Operations Manager, Frankfurt 🇩🇪

Hengbao International: Blockchain Architect (Digital Assets), Remote 🇪🇺

Northern Trust: Specialist, Business Analysis, Digital Assets and Innovation, London 🇬🇧

Sygnum: Head of Investor Relations, Zurich🇨🇭

S&P Global: Data Owner for Crypto & Digital Assets, Amsterdam 🇳🇱 / London 🇬🇧

A conversation with Kelly Mathieson, Chief Business Officer at Digital Asset, following the firm’s role in facilitating the first fully onchain U.S. Treasury repo transaction on the Canton Network, executed with DTCC, Tradeweb, Circle, and major market participants.

Blockchains for TradFi (a16z Crypto) — A strategic primer for banks, asset managers, and fintechs on how to approach blockchain integration, covering infrastructure design and key use cases across capital markets.

Visa’s Stablecoin Strategy (Bloomberg) — An article about how Visa is expanding its role in stablecoin payments through bank partnerships, onchain settlement, and a tokenized asset platform.

Deka Digital Asset Monitor H1 2025 (DekaBank) — A semi-annual report tracking tokenization activity in Germany, covering issuance volumes, deal types, regulatory hurdles, and market infrastructure developments under the DLT Pilot Regime.

📚 Want more good reads? Our Library features 100+ hand-picked reports on stablecoins, tokenization, and more — updated weekly.

👉 Get access by sharing our newsletter with one friend or colleague using your personal referral link: {{ rp_refer_url }}

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.