Oh, how times change. Back in 2017, Jamie Dimon vowed to “fire any trader in a second for trading Bitcoin.” Yesterday Bloomberg reported that JPMorgan plans to let trading and wealth-management clients use cryptocurrency-linked assets — starting with BlackRock’s IBIT — as collateral for loans.

While Dimon may not be lining up to buy sats himself, it’s certainly a full-circle moment for an asset once dismissed as volatile, speculative, and beloved by money launderers — hardly the kind of thing you’d bring to your banker.

Now Bitcoin has formally entered the canon of acceptable collateral at the world’s most systemically important bank. In a TradFi wrapper, of course.

Here are the week’s biggest stories we’re unpacking today:

SG-Forge partners with BCB Group to expand EURCV distribution

SEC declares protocol-level staking not a security

IG launches crypto trading for retail customers

Forwarded this email? Subscribe here for more.

NEWS FLASH

Tokenization

Clearstream and Azimut launch DLT private funds platform. The goal is to launch a DLT-based private funds solution via FundsDLT, aiming to reduce costs and improve transparency across fund distribution.🪙

Deutsche Bank joins Partior for real-time settlement. Germany’s largest bank will serve as a Euro and USD settlement bank on Partior, a blockchain platform enabling real-time, cross-border settlement of tokenised assets.🏦

Regulation

U.S. lawmakers propose CLARITY Act for crypto framework. House Republicans and Democrats introduced the bipartisan CLARITY Act to bring regulatory clarity to digital assets, building on the FIT 21 bill passed by the House last session.🇺🇸

Singapore to shut down unlicensed offshore crypto firms. MAS has given crypto firms serving offshore clients until 30 June 2025 to get licensed or exit. Licenses will be rare, as MAS warns such firms pose reputational and money laundering risks without local oversight.🇸🇬

Bybit obtains a MiCA license in Austria. The crypto exchange has secured a MiCA license in Austria, allowing it to offer crypto services across all EU member states and the European Economic Area.✅

Investment

Kraken launches prime brokerage for institutions. The crypto exchange has rolled out Kraken Prime, a full-service platform offering institutional clients integrated trading, custody, and financing.🐙

IG partners with Uphold for UK crypto trading. IG Group becomes the first UK-listed investment platform to offer crypto via a partnership with Uphold, initially supporting 13 crypto-assets. More on that below in today’s Proof-of-Talk with Uphold CEO Simon McLoughlin.🇬🇧

STABLECOINS

SG-Forge Partners with BCB to Expand EURCV Stablecoin Distribution

New partner: SG-Forge, the digital asset arm of Societe Generale, has partnered with BCB Markets to distribute its euro-denominated stablecoin, EURCV, to institutional clients. The move gives over 450 institutional players direct access to EURCV through BCB’s infrastructure.

Why it matters: SG-Forge is one of only two banking groups in Europe operating a MiCA-compliant euro stablecoin, alongside Banking Circle. The partnership expands EURCV’s potential reach through one of crypto’s leading fiat settlement networks.

"Our clients are increasingly looking for euro alternatives to dollar-based stablecoins, especially in cross-border flows," said Jérôme Prigent, Managing Director of BCB Europe.

Who is BCB: Founded in 2017, BCB Group is a regulated payments and trading infrastructure provider for digital asset firms, licensed in both the UK and France. Its core clients include exchanges, market makers, and OTC desks. BCB also operates BLINC — a 24/7 fiat settlement network that processed over $25.9 billion in 2023 — and was recently named a design partner in Circle’s institutional payment network (CPN).

How it works: With the integration of EURCV, BCB clients can now extend the benefits of the BLINC model onchain — using a fully regulated euro stablecoin issued by a systemically important European bank.

“The integration of EURCV lets clients replicate our fiat settlement model using a fully regulated euro stablecoin,” said Prigent.

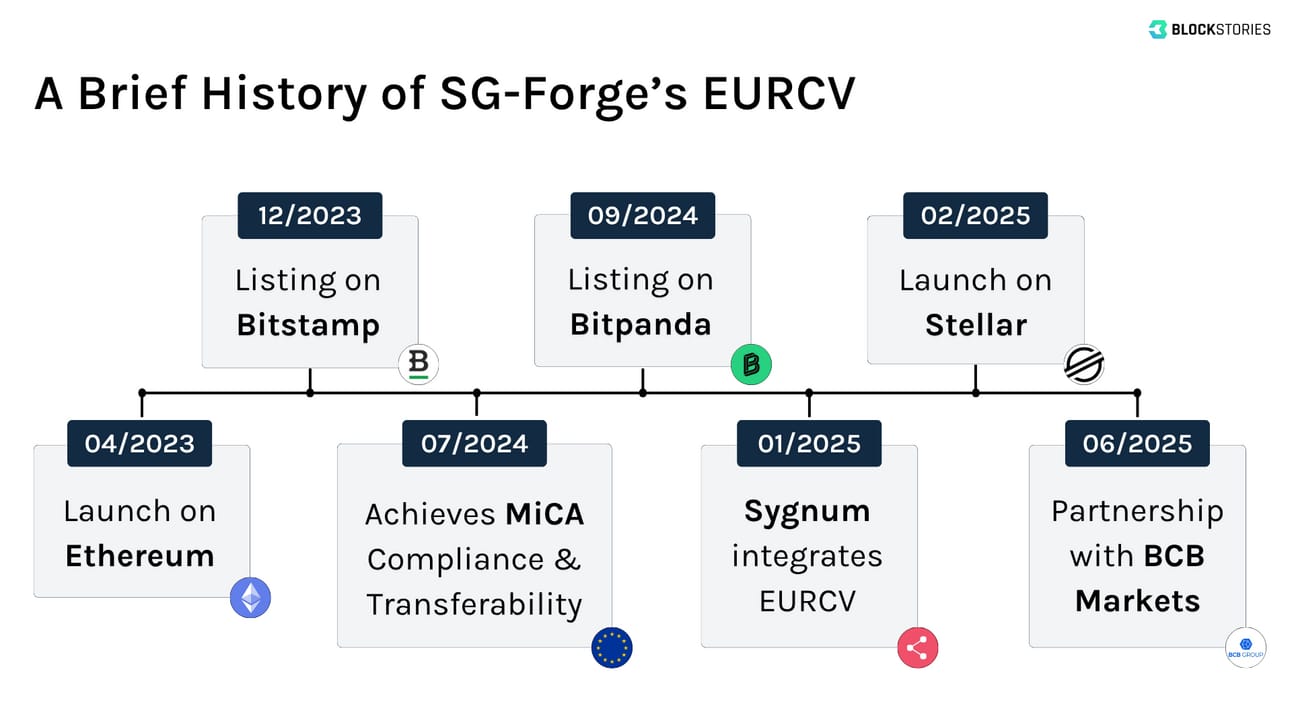

A growing network: Since launching EURCV in April 2023 and securing its MiCA license last summer, SG-Forge has steadily expanded its ecosystem. Distribution partners include Bitstamp, Bitpanda, and Sygnum. The token initially launched on Ethereum and recently went live on Stellar, with additional rollouts planned on the XRP Ledger and Solana as part of a multi-chain strategy.

Slow adoption: Around €41 million in EURCV has been issued to date, with over 90% held by four wallets. Roughly €25 million remains untouched. While the rollout reflects a cautious, compliance-driven approach, adoption has also raised doubts about execution and market pull.

A prominent departure: These questions may also help explain a recent change in leadership. Just days ago, Guillaume Chatain, former Chief Revenue Officer, left SG-Forge to join market maker Keyrock. As the most visible face of EURCV in the DeFi ecosystem, his departure hints at a broader shift — from DeFi-facing integrations toward institutionally driven distribution.

Emergent use cases: Recent partnerships hint at this evolving direction. The integration with BCB gives SG-Forge direct access to regulated liquidity corridors across Europe, the Middle East, and Latin America — with cross-border payments emerging as a key use case.

Jean-Marc Stenger, CEO of Societe Generale – FORGE, noted: “The collaboration with BCB Markets supports the expansion of the EURCV stablecoin as an effective means of payment across various geographies and use cases.”

The slow development of SG-Forge’s stablecoin can be frustrating at times — especially compared to Circle’s EURC, which is gaining traction in DeFi. But it reflects the logic of a banking incumbent: build infrastructure for regulated counterparties first.

“SG-Forge first and foremost wants to be seen as a partner for major institutional players. Spreading itself across DeFi or multiple platforms wouldn’t make sense for them,” says a source close to the bank.

While attention still largely focuses on DeFi, isn’t it the more strategic play to start onboarding traditional players with a bank-grade stablecoin? Especially considering adoption is only just beginning.

Due to regulatory and reputational concerns, banks have yet to fully enter the stablecoin market, which remains largely dominated by investment and trading within decentralized finance (DeFi).

However, there is a clear use case beyond DeFi — including cross-border and intra-group payments — enabling faster cash delivery and more efficient treasury management. The real utility traditional institutions are targeting with stablecoins lies in moving money and serving as the settlement leg of asset transfers.

These are the kinds of partnerships that have been multiplying in recent months, as illustrated by traditional players like BCB Group teaming up with Société Générale.

Varun Paul is the Senior Director of Financial Markets at Fireblocks. Prior to joining the digital asset infrastructure firm, he spent over 13 years at the Bank of England.

REGULATION

SEC Declares Protocol-Level Staking Not a Security

Regulatory clarity: For the first time, the SEC has formally stated that core staking activities on public Proof-of-Stake (PoS) networks do not constitute securities offerings. In a Staff Statement issued by the Division of Corporation Finance on May 29, the agency concluded that staking services — when structured as administrative or ministerial functions — fall outside the scope of the Howey test for investment contracts.

Why it matters: The statement offers long-awaited clarity for staking participants in the U.S. marking a shift from the SEC’s prior enforcement-first approach, which included actions against Coinbase and Kraken. While not legally binding, the guidance signals a new posture: from litigation to interpretation.

“This previous position effectively froze the staking industry in the U.S. The SEC’s clarity on core protocol staking marks an important step toward enabling asset managers, banks, and other institutions to participate in Proof-of-Stake networks.” said Laszlo Szabo, CEO of Kiln, a leading staking platform, to Blockstories.

A new framework: The SEC outlines three staking models, offering a clear compliance roadmap:

Solo staking: Users run their own nodes and stake assets they control which the SEC considers a technical contribution, not a securities offering.

Delegated staking (non-custodial): Users delegate validation rights while retaining custody. Operators perform a service, but don’t offer guaranteed returns.

Custodial staking: Custodians may stake user assets but must not trade, lend, or enhance yields. The rewards must be protocol-defined, not fixed or enhanced by the custodian.

Green light for added services: Beyond the core staking models, The SEC also clarified that ancillary services — like slashing protection, early unbonding, flexible reward payouts, and stake aggregation — are permissible if they remain administrative and avoid yield enhancements.

More product differentiation: This opens design space for institutional staking providers to differentiate offerings without triggering securities concerns.

What’s not covered: The guidance excludes liquid staking, restaking, and hybrid models involving transferable tokens or pooled discretion — leaving parts of the market in regulatory limbo.

State-level resistance remains: The SEC’s position also doesn’t override state regulations. States like California, New Jersey, and Washington continue to restrict certain staking services, preventing platforms like Coinbase from offering them locally.

What’s next:

Further guidance: The Staff Statement still leaves room for further guidance. Commissioner Hester Peirce noted that additional clarity is expected on staking-adjacent activities, suggesting this is just the beginning of a broader shift in policy.

ETH Spot ETFs: One area where new clarity may soon emerge is staked ETH spot ETFs. The SEC’s stance could influence pending approvals for funds that include staking components. On May 9, BlackRock met with the agency’s Crypto Asset Task Force to discuss just that.

The SEC’s May 2025 Statement represents a paradigm shift in the regulatory framework governing proof-of-stake (PoS) protocols, establishing clear parameters for operational compliance.

The implications for ETF and ETP markets are substantial and immediate. Despite BlackRock’s ETHA fund’s impressive performance as one of 2024’s top six ETF launches with $3.5 billion in inflows, the exclusion of staking capabilities has limited these products’ appeal to crypto-native investors. The new framework enables the development of enhanced ETF structures that incorporate staking yields through total return methodologies, with daily performance tracking and compound reward calculations.

Beyond traditional ETF/ETP formats, the framework unlocks a broader design space for structured products. Expect innovations akin to securities lending — but with potentially higher yields:

Margin lending facilities collateralized by staked assets, enabling dual-yield generation through both staking rewards and lending fees

Structured notes combining staking rewards with option overlays,

Synthetic products offering leveraged exposure to staking returns,

Hybrid investment vehicles dynamically allocating between staking and traditional yield strategies

As these products gain traction, they could accelerate institutional capital into PoS networks — reshaping both portfolio construction and the economics of blockchain security. Staking yields may soon become an integral component of modern portfolio management.

Anne-Sophie Cissey is the Group General Counsel at Kaiko, a leading provider of cryptocurrency market data, analytics, and indices.

BNP Paribas Asset Management: Digital Strategy & Investment Lead – Blockchain & AI, Warsaw 🇵🇱

Citi: Market Risk Manager, Digital Assets, London 🇬🇧

Revolut: General Manager (Crypto Institutional), London 🇬🇧 / Barcelona 🇪🇸

Santander: Crypto Program Manager – DCB Global, Madrid 🇪🇸

Spiko: Compliance Officer, Paris 🇫🇷

State Street Global Advisors: Head of Digital Assets Strategy, London 🇬🇧

Thunes: Product Lead Digital Assets, Paris 🇫🇷

A chat with Simon McLoughlin, CEO at Uphold, following their new partnership with IG — whose crypto services are now powered by Uphold’s infrastructure.

Blockchain Identity Report (Chainlink) — explores the current state of digital verification in financial services, outlining the opportunity for blockchain-enabled identity.

5 countries reshaping the digital asset map (WisdomTree) — A data-driven blogpost on how Nigeria, the United States, the United Arab Emirates, Brazil and South Korea are embracing crypto.

Euro Stable Watch (Newsletter) — A new bi-weekly publication by Marieke Flament and Nicolas Colin on the euro stablecoin space.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.