Yesterday, the $6 trillion asset manager Fidelity Investments announced it will launch a U.S. dollar-based stablecoin, FIDD, on Ethereum in the coming weeks.

This move positions Fidelity as the second global asset manager, after WisdomTree, to enter the stablecoin market. Similar to its competitor, FIDD is designed to complement an existing tokenized money market fund, pointing to a growing institutional appetite for moving efficiently between cash and yield on a 24/7 basis.

Notably, the announcement also highlights Fidelity’s intention to list FIDD on major exchanges. And while Tether likely won’t have to fear for its lunch on Binance and Bybit, it will certainly catch the eye of CME or ICE.

Today, we’ll take you behind the scenes of:

How Europe’s banks are building their crypto retail offering

Lloyd’s of London invests in risk infrastructure provider Circuit

🇬🇧 London calling: Next Wednesday (February 4), we’re coming to London for an exclusive evening on the key trends to watch in digital assets in 2026. There are only a couple of spots left. Join us!

HIGH SIGNAL NEWS

ECB plans to accept tokenized assets as collateral. As of March 30, 2026, tokenized securities will be eligible as collateral on the same basis as traditional securities, provided they are issued and settled through CSDs connected to TARGET2, the European interbank payment system. 🇪🇺

UBS plans to offer crypto trading for wealth clients. According to Bloomberg, the Swiss banking giant is currently selecting partners to launch the offering, initially targeting clients of its private bank in Switzerland. 🇨🇭

ING allows its retail clients to gain exposure to crypto assets. Last week, the Netherlands’ largest bank officially rolled out its offering through Bitcoin, Ethereum, and Solana ETNs. 🇳🇱

Zerohash is reportedly seeking to raise $250 million. The round would value the company at around $1.5 billion, according to CoinDesk. It follows Zerohash’s recent decision to turn down an acquisition offer from Mastercard. Founded in 2017, the company works with firms such as Franklin Templeton, BNY, and BlackRock, providing infrastructure that enables financial institutions and fintechs to offer crypto, stablecoin, and tokenization products. 🇺🇸

TOP STORY

From Full-Stack to Modular: How Banks Are Building Their Crypto Retail Offering

An accelerating trend: Over the past few months alone, several major European banks, including DZ Bank, KBC, and Groupe BPCE, have either announced or launched retail crypto offerings. Market participants consulted by Blockstories expect this momentum to accelerate significantly in 2026, as more European banks launch or expand retail crypto services.

Why it matters: Regulatory frameworks such as MiCA have helped legitimize crypto within banks, allowing digital assets to be treated as a standard financial product. It is also a defensive move. With direct visibility into retail money flows, banks can see how client funds are moving to crypto platforms, prompting them to view crypto more as a competitive necessity.

“Banks can clearly see how much money is being transferred from their own retail clients to crypto platforms. That has been a major trigger pushing them to act,” says Roman Schmidt, Chief Market Officer at tradias, one of Europe’s leading liquidity providers.

Another key driver lies in fee economics, as crypto trading can potentially generate higher fees than traditional products. “That’s something banks have also looked at very closely,” Schmidt adds.

Behind the scenes: To understand how this shift is playing out in practice, Blockstories spoke with several European banks as well as with Bitpanda Technology Solutions, Boerse Stuttgart Digital and tradias, three of the leading providers powering the crypto offerings of European banks today. Our condensed findings are presented below.

__________________

1) Which European markets and bank types are moving fastest?

/

The German-speaking region is among the most advanced, reflecting years of regulatory engagement with crypto custody and market infrastructure. This is reinforced by Germany’s federated banking structure, where savings banks and cooperative banks rely on shared service platforms. Both the Sparkassen and Volksbanken networks are preparing broad retail crypto launches backed by their central institutions, with rollouts expected in 2026.

Southern Europe, particularly Spain, shows some of the strongest demand signals. France, by contrast, has moved more cautiously, reflecting a traditionally conservative retail banking culture, though momentum is now building there as well.

Across all markets, the sequence of adoption is consistent. Private banks such as AMINA and Bank Frick, along with institutional-focused players like Sygnum, moved first, as crypto exposure for professional clients is easier to justify from a risk and suitability standpoint. Digital banks and brokerage-led platforms such as N26 and Trade Republic generally followed, while large universal retail banks are expected to move last.

2) What does a typical bank crypto setup look like at launch?

At launch, many banks tend to opt for a full-stack crypto-as-a-service setup rather than assembling a modular architecture from day one. A typical example is the neobank N26, which rolled out a retail crypto offering in 2022 based on Bitpanda’s white-label solution.

“Banks don’t struggle with strategy, they struggle with execution. Early on, it became clear that offering crypto isn’t one problem but many interconnected ones: Regulation, custody, trading, liquidity and operations.”

This approach allowed banks to move quickly while outsourcing the operational complexity of crypto, which spans trading infrastructure, liquidity access, custody, settlement, and compliance tooling. The bank typically retains control over the customer relationship, onboarding, front-end, and risk governance, while relying on external providers to run the crypto-specific plumbing.

“Banks usually don’t have the final operating model in mind from day one. They start with what they can realistically get approved, and they need an infrastructure that can evolve alongside them.”

There is, however, no single standard blueprint. Some banks, such as KBC, launch crypto via their existing brokerage platforms, offering digital assets alongside equities and ETFs, while others roll out a dedicated crypto module within their retail app, as seen with Hexarq, developed by the French banking group BPCE, or meinKrypto by DZ Bank.

3) Why do most banks start with closed-loop offerings?

For many banks, closed-loop launch models are a pragmatic starting point. For example, KBC explicitly adopted a closed-loop structure for crypto trading on Bolero, where clients can only buy and sell within the platform and cannot transfer assets in or out.

This approach is materially simpler than enabling onchain transfers, which introduce additional requirements around wallet verification, transaction screening, and travel-rule compliance. These processes are unfamiliar to most retail banking operations and significantly increase operational complexity at launch.

4) How is this operating model expected to evolve over the next years?

Over time, bank crypto offerings are expected to shift from integrated, full-stack setups toward more modular architectures.

As internal expertise grows, the clearest evolution path is selective insourcing, particularly around custody. Safekeeping digital assets aligns closely with traditional banking responsibilities, and some institutions see long-term strategic value in owning this function.

By contrast, areas such as liquidity provision and execution are expected to remain largely outsourced, as running 24/7 crypto markets at scale is operationally demanding and offers limited differentiation for most banks.

5) Where do stablecoins fit into this picture?

While much discussed, banks largely treat them as a parallel track with different use cases and timelines. In retail, euro-denominated stablecoins do not yet offer a compelling value proposition over existing bank money.

That said, in conversations with banks participating in the euro stablecoin consortium Qivalis, integrating the stablecoin into retail crypto trading offerings for settlement is frequently cited as a key demand driver.

Apex Group: Head of Product - Tokenized funds and SPVs, Madrid 🇪🇸

Caixa: Blockchain & Digital Assets Architect, Madrid 🇪🇸

PwC: Manager Digital Assets, Berlin 🇩🇪

Raiffeisen Bank International: Senior Technology Business Strategist, Vienna 🇦🇹

Robinhood: Risk Governance Senior Specialist, London 🇬🇧

Rothschild & Co: VC Principal - Digital Asset Investing, Paris 🇫🇷

Sygnum: Product Lead Stablecoins, Zurich 🇨🇭

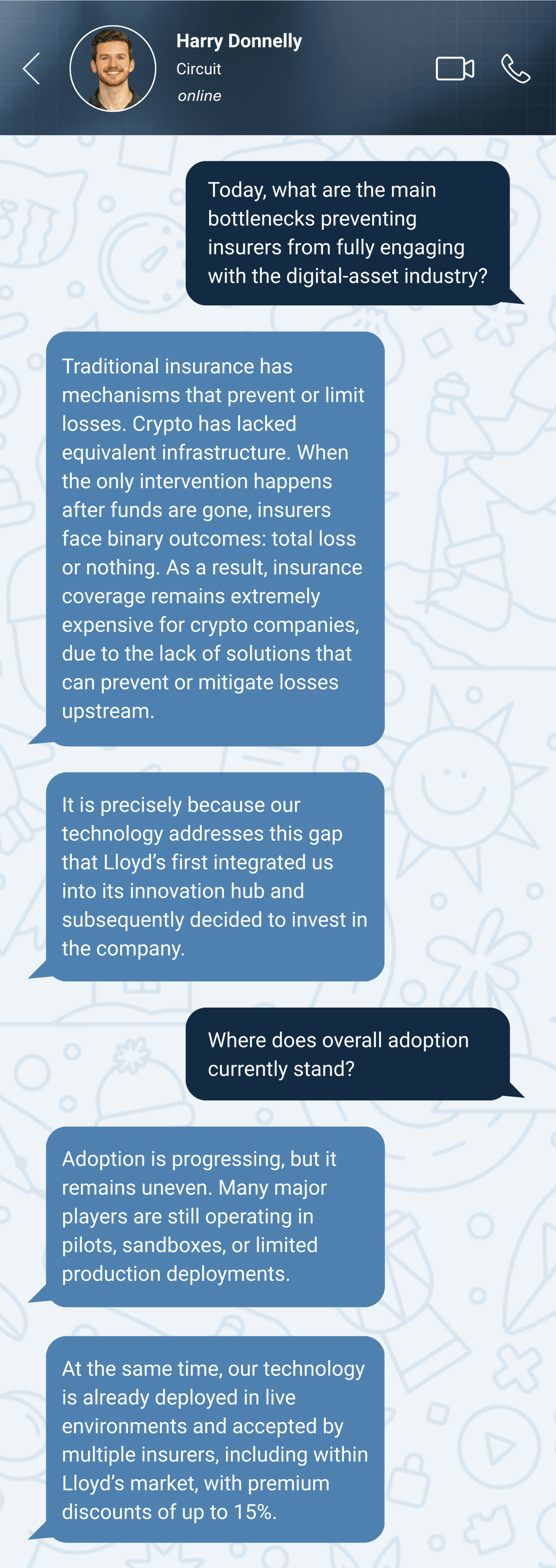

What’s the news?

Last week, U.S.-based risk infrastructure provider Circuit announced a strategic investment from Lloyd’s of London. This is the first publicly disclosed direct investment in a digital asset company by the world’s largest specialty insurance market.

Lloyd’s of London is a British marketplace where insurers from around the world come together to share and cover big or unusual risks, like natural disasters, ships, or satellites, handling more than £55 billion in insurance business each year.

Founded in 2023, Circuit has developed an automated recovery platform for digital assets that helps institutions maintain access to funds if private keys are compromised or custodial systems fail. The technology enables real-time transfers to predefined safe destinations during security incidents.

Behind-the-scenes: We spoke with Harry Donnelly, CEO and founder of Circuit, to better understand the key bottlenecks insurers face when entering the digital assets industry and the current state of adoption.

Stablecoins in Payments (McKinsey & Artemis Analytics) — An analysis arguing that raw onchain stablecoin volumes largely overstate real payment activity, and that once adjusted, usage is smaller but growing, with the clearest opportunities in B2B and cross-border payments.

Reimagining European Capital Markets (Citi) — A report arguing that Europe’s fragmented post-trade infrastructure undermines capital formation, and that greater harmonization, enabled in part by DLT and tokenization, is critical to improving liquidity, efficiency, and market integration.

The Stablecoin Toolkit (Wharton BDAP) — A report mapping the stablecoin landscape by outlining key models, market dynamics, and use cases, and positioning stablecoins within the broader spectrum of digital money.

→ Want more? Visit Blockstories Library for a curated selection of 120+ reports on digital assets.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.