We’re writing from London, fresh off a packed Horizon Summit. On the agenda was a keynote by Olena Clayton of Google Cloud on bringing commercial bank money onchain.

While she spoke, one of Google Cloud’s flagship clients, CME Group, was on its earnings call. CEO Terry Duffy dropped a trio of notable insights:

CME plans to launch its own tokenized cash product later this year, in partnership with Google and a depository bank, with a focus on streamlining collateral management.

CME is open to accepting external tokenized cash products but stressed they’ll be selective and closely assess counterparty risk.

They’re already exploring extending their token to other chains, taking a page from JPMorgan’s playbook.

Markets are pushing toward 24/7, and this shift might happen sooner than expected.

Today, we take you behind the scenes of:

ECB plans to accept tokenized securities as eligible collateral

Talos raises $45 million to accelerate convergence of traditional and crypto assets

HIGH SIGNAL NEWS

AllUnity is set to launch a CHF-denominated stablecoin in February. It will be the second stablecoin following the EURAU (euro), launched by the joint venture formed by Galaxy, Flow Traders, and DWS. 🪙

Boerse Stuttgart Group settles its first confidential transaction on a public blockchain. The operation was executed via its DLT platform Seturion on Aztec, an Ethereum Layer-2. As a result, only the seller, buyer, issuer, trading and settlement venues, as well as regulators, can decrypt transaction events, amounts, balances, and counterparties. 🇩🇪

BBVA joins the European banking consortium Qivalis. It is the twelfth bank to do so. The consortium, which has applied for an electronic money institution licence in the Netherlands, plans to issue a euro-denominated stablecoin in the second half of this year. 🇪🇺

Deutsche Börse partners with Bitpanda for crypto trading. The partnership aims to enable the financial market infrastructure group’s partner banks to offer crypto trading services to their clients. 🤝

Bison Bank plans to launch a stablecoin in 2026. The Portuguese private bank intends to use the token to enhance cross-border payment efficiency and lower transaction costs for its clients across more than 140 countries. 🇵🇹

TOKENIZATION & WHOLESALE CBDC

Eurosystem Greenlights Tokenized Collateral for March 2026

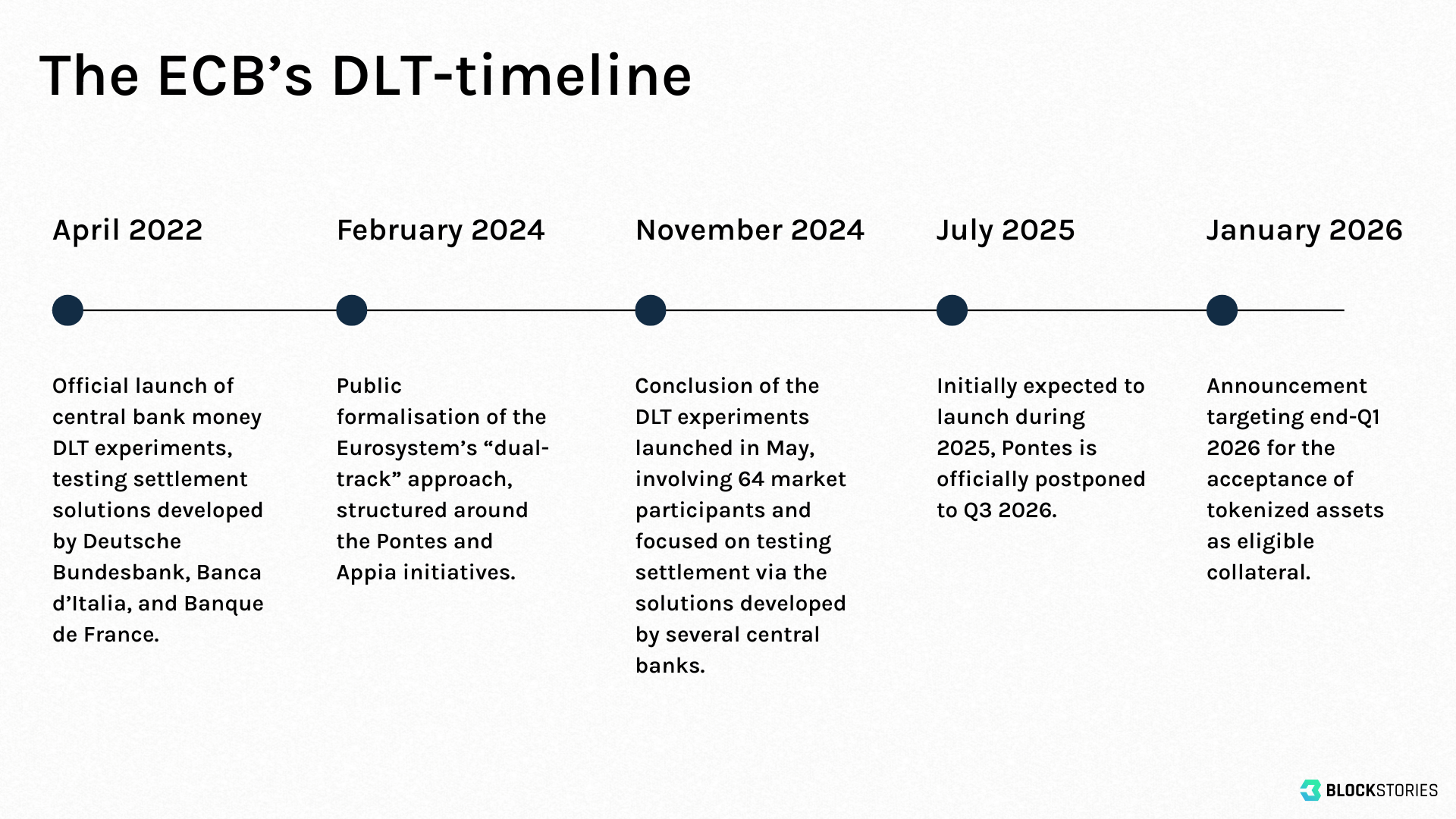

New unlock for tokenization: Last week, the European Central Bank announced a decisive step toward integrating tokenized securities into the core of the Eurosystem. From 30 March 2026, the Eurosystem, comprising the ECB and the national central banks of the euro area, plans to accept DLT-based securities as eligible collateral for its credit operations.

Why it matters: Until now, tokenized assets have largely sat outside the central bank collateral framework. Holders could invest in them, but could not use them in central bank refinancing operations, one of the foundations of modern monetary and liquidity management. This limitation weakened the economic case for tokenization, particularly for banks and institutional investors.

Here are the core details:

Asset eligibility: Tokenization does not alter eligibility criteria. Only assets already accepted under the ECB’s collateral framework, such as euro-area sovereign bonds, covered bonds, or corporate bonds, can qualify.

CSDs only, for now: Eligible tokenized securities must be issued on DLT infrastructures operated by regulated central securities depositories, including providers such as Clearstream, Euroclear, or Iberclear. Purely DLT-native platforms under the Pilot Regime are not yet included, although the ECB has signaled further exploration.

Central bank money remains the anchor: In the initial phase, collateralized credit operations will continue to settle in conventional central bank money via TARGET2-Securities. Over time, the ECB plans to introduce wholesale CBDC under its dual-track approach, combining the Pontes and Appia initiatives.

__________________

Industry perspectives: To understand what this decision changes in practice, we spoke with three leading market participants:

The CSD perspective (Clearstream) on what this decision will mean in practice for clients.

The asset manager perspective (Union Investment) on how this impacts the economics of tokenized assets

The DLT-infrastructure perspective (Deka) on why eligibility should be extended to DLT-based market infrastructures.

Thilo Derenbach is Head of Sales & BD, Digital Securities Services at Clearstream, the post-trade subsidiary of financial market infrastructure group Deutsche Börse. One of its key initiatives has been the launch of D7 DLT, a platform that enables issuers to create and manage securities directly onchain while remaining compliant with Europe’s Central Securities Depository Regulation (CSDR).

What changes for issuers and investors using Clearstream?

For us at Clearstream, the ECB’s decision is a decisive moment because it means we can integrate tokenized issuance fully into the Eurosystem framework instead of treating it as a parallel construct.

In practice, this starts at issuance. Until now, tokenized securities issued natively on DLT could be held on chain but could not be mobilized or reused for further liquidity or funding activities. What changes now, is that tokenized securities issued via D7 DLT can be used directly as collateral in our triparty collateral management engine and the Eurosystem Collateral Management System (ECMS). For our clients, a tokenized bond no longer sits idle. It can be reused, refinanced, and managed in exactly the same way as a traditional security, without conversion or manual workarounds.

On the cash side, refinancing in ECMS continues to settle in traditional central bank money, as it does today. In parallel, Clearstream is preparing to support a broader range of digital payment options for delivery-versus-payment transactions. Once the ECB’s wholesale CBDC initiative Pontes goes live, clients will be able to settle securities transactions using central bank money, tokenized commercial bank money, or MiCA-compliant stablecoins. We are currently working on integrating these offerings, including solutions from different stablecoin issuers, into Clearstream’s regulated infrastructure, with an ambition to grow the scope of partners further.

The objective is to enable digital cash and tokenized securities to move on the same operational rails and to interoperate ecosystems so that cash and securities can move between traditional and blockchain environments.

Christoph Hock is the Head of Tokenization and Digital Assets at Union Investment. Union Investment is one of Germany’s largest asset managers and an early, active investor in tokenized bonds, participating in several high-profile digital bond issuances including those from the European Investment Bank and Siemens.

How does it impact the business case for tokenization?

Tokenization has the potential to materially improve the economics of capital markets. However, in practice, DLT-based bonds have often been more costly for issuers rather than cheaper. A major contributing factor is their current ineligibility as collateral at the ECB.

Investing banks typically hold these DLT-based bonds either in their treasury or trading books on their balance sheets. Since assets that cannot be pledged as collateral at the ECB are inherently less valuable to banks, this limitation impacts pricing. Combined with limited secondary market liquidity on regulated venues, issuers are usually forced to offer investors a yield premium, increasing their funding costs compared to traditional bonds.

The recent ECB decision to recognize DLT-based securities embedded within traditional CSD structures is a first positive development toward correcting this imbalance and fostering a scalable level playing field in the future, especially in the context of global competition. However, it currently excludes several notable native DLT issuances, including those by leading German issuers.

Therefore, achieving a genuine level playing field will require expanding eligibility beyond traditional frameworks, alongside secondary market liquidity, and the availability of DLT-compatible forms of payment for settlement. When these factors align, tokenization can evolve from being a cost driver into a clear structural advantage, unlocking the full potential benefits for both investors and issuers.

Michael Cyrus is the Head of Short-Term Products, Equity Finance & FX at Deka. Deka has been an active participant in the ECB’s DLT settlement trials and was the first bank to receive a BaFin-regulated crypto securities registrar license. It is also a major stakeholder in SWIAT, a Frankfurt-based infrastructure provider preparing to launch the Regulated Layer One blockchain, a shared ledger governed by ten European financial institutions, including ABN AMRO, Natixis CIB, and NatWest.

What about DLT-native infrastructures?

This is a welcome step toward broader collateral eligibility. However, a more fundamental question remains: systemic relevance today is still largely derived from institutional form, specifically, CSD status, rather than from functional robustness.

Going forward, eligibility should depend on whether a DLT infrastructure demonstrably provides functional stability, sound governance, and settlement finality, not on conformity to traditional institutional structures.

Defining such functional thresholds could unlock meaningful innovation while preserving the core safeguards of the system, and would give DLT infrastructures a clear path to developing CSD-equivalent functionality with considerable potential for European capital markets.

BNY: VP - Digital Assets Product Strategy & Commercialisation, London 🇬🇧

Crypto(.)com: Senior Product Manager, Card, Paris 🇫🇷

Goldman Sachs: Tokenisation, Vice President, London 🇬🇧

Keyrock: Product Manager (Trading), Luxembourg 🇱🇺

N26: Senior Product Manager - Cards & Digital Wallets, Berlin 🇩🇪

Revolut: Head Financial Crime Compliance (Crypto), Remote 🌐

Ripple: Policy Manager, Europe, Luxembourg 🇱🇺

Robinhood: Senior Growth Engagement Manager, Crypto - Institutional, Luxembourg 🇱🇺

What’s the news?

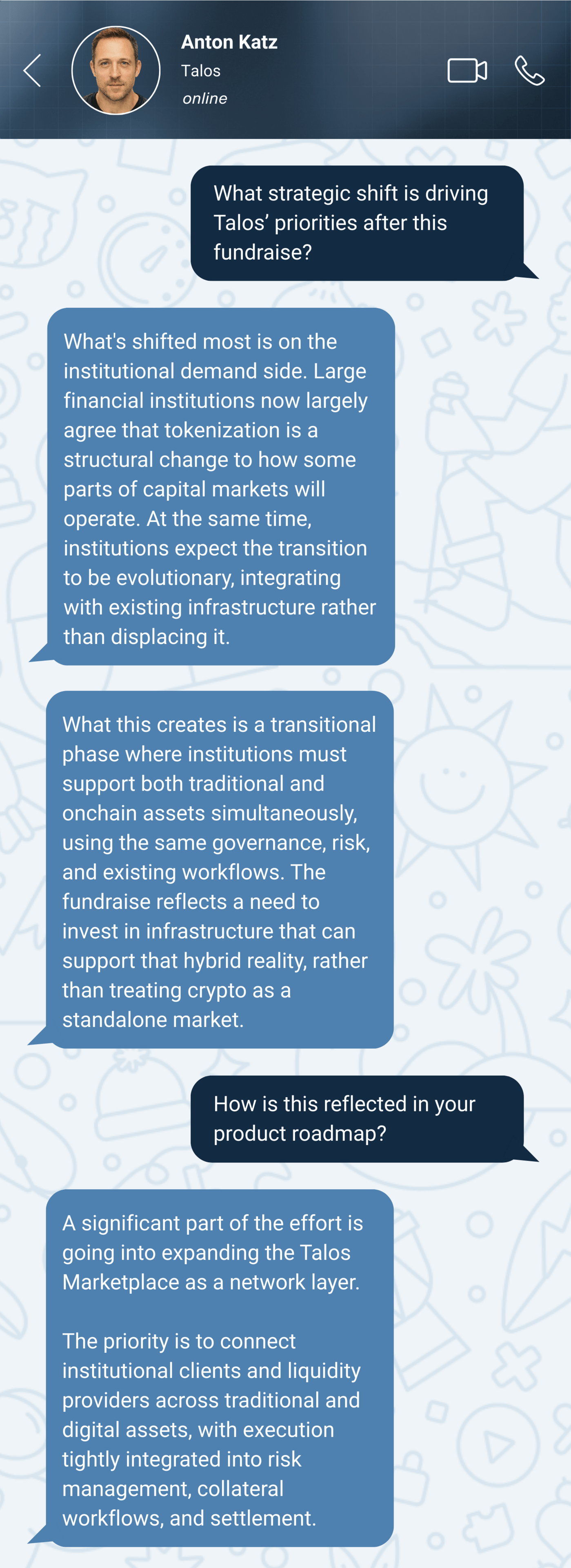

Last week, U.S-based trading infrastructure provider Talos announced a $45 million funding extension, bringing the round’s total proceeds to $150 million and valuing the company at approximately $1.5 billion post-money.

About Talos: Its platform gives banks, brokers, asset managers, and market makers unified access to crypto markets, combining execution, liquidity, market connectivity, and compliance tools. In October, its order and execution system was integrated into Aladdin, BlackRock’s flagship platform for portfolio and risk management used by institutional investors.

Acceleration: “2025 was the first year in which more than half of the contracts we signed were with traditional financial institutions. Institutional adoption has accelerated significantly over the past 18 months,” said Anton Katz, co-founder and CEO of Talos, to Blockstories.

Behind the scenes: We spoke with Katz about the strategic priorities behind the fundraise and the products being developed to meet growing institutional demand.

Stablecoin Payments (BCG & Allium Labs) — A study dissecting onchain stablecoin flows to separate real‑economy payments from trading activity, quantifying their current scale, growth, and use cases across chains and payment segments.

Money as a Coordination Device (BIS) — A lecture tracing how public blockchains reshape money’s coordination role, highlighting validator‑driven consensus, congestion and fees, and the resulting fragmentation of stablecoin activity across non‑interoperable chains and rollups.

→ Want more? Visit Blockstories Library for a curated selection of 120+ reports on digital assets.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.