It’s license season in Europe. Baader Bank, Caceis, and Amdax all secured MiCA authorizations in the past few days, joining the expanding cohort of firms now operating under the EU’s unified digital asset regime.

And the momentum doesn’t stop there. On the stablecoin front, AllUnity, the joint venture between Galaxy, DWS, and Flow Traders, just picked up an E-Money license from BaFin, clearing the way for its euro stablecoin to go live.

Licenses are now being handed out like lollipops at a school fair. Expect the announcements to keep coming.

This is what we talk about today:

ECB announces dual-track strategy for DLT-based settlement

RWA Summit Cannes: Apollo, JPM and co. double down on tokenization

Taurus deploys private stablecoin smart contract

Forwarded this email? Subscribe here for more.

HIGH SIGNAL NEWS

Germany’s Sparkassen to offer crypto trading by 2026. The country’s public savings banks will offer access to regulated crypto assets via the Sparkasse app by mid-2026, using DekaBank’s infrastructure. Implementation is planned within twelve months, but the group will not actively promote or advise on crypto investments.🇩🇪

Swiss National Bank extends Project Helvetia wholesale CBDC pilot. The SNB will continue testing wholesale CBDC on SIX Digital Exchange through mid-2027 as part of Project Helvetia. The extension doesn’t imply a permanent rollout.🇨🇭

Korea pauses CBDC project as banks pivot to stablecoins. The Bank of Korea has paused Project Han River after pushback from major banks, which now plan to issue stablecoins under new government rules.🇰🇷

Circle applies for U.S. national trust bank charter. The stablecoin issuer has applied to the OCC to establish a national trust bank — a move that could open access to a Fed master account. It would let Circle directly hold its reserves and offer custody for tokenized assets like stocks and bonds to institutional clients.🇺🇸

TOKENIZATION

ECB Announces Dual-Track Strategy For Settlement of DLT-Based Assets

Clarity with caveats: The European Central Bank has unveiled a dual-track strategy to enable wholesale settlement of tokenized assets in central bank money. The announcement marks the clearest signal yet that the ECB considers DLT a relevant market infrastructure. But the message comes with a caveat: the first implementation won’t arrive before Q3 2026.

Following the ECB trials: The new strategy builds on last year’s large-scale trials, where 64 institutions tested three approaches to settling tokenized assets in central bank money moving nearly €1.6 billion across separate systems. While technically successful, none of the solutions were selected as-is. Instead, the ECB chose a composite approach.

Two-track strategy: Rather than picking a winner, the ECB opted for a dual-track model:

Pontes (short term): A trigger-based solution linking DLT platforms to the Eurosystem’s TARGET Services, scheduled for pilot launch in Q3 2026.

Appia (long term): A forward-looking initiative to develop a fully integrated wholesale CBDC infrastructure which is designed to support programmability, atomic settlement, foreign exchange, and cross-border use cases within a harmonized European framework.

A clear direction, but a long wait: The dual-track model offers welcome clarity to institutions building tokenized infrastructure. But the timeline is slower than expected.

“This will provide the market with planning certainty it has been seeking,” says Dirk Kruwinnus, Strategy Lead for Digital Assets and Tokenized Securities at Boerse Stuttgart Group. “Even if it comes later than the market might have hoped, the key takeaway is: DLT use cases will have a path to central bank money.”

Why the delay? Pontes was initially expected to go live in early 2026, but has now been pushed to Q3. Sources close to the process say the delay stems from the ECB’s decision to merge elements from all three tested systems rather than selecting one.

A political compromise: The three central banks behind the pilots played distinct roles:

Germany’s Trigger Solution was seen as the most mature and closely aligned to act as a bridge with TARGET infrastructure.

France’s DL3S featured a full DLT-based architecture and was positioned as a longer-term option.

Italy’s Hash-Link was considered less central, acting as a lightweight connector to TIPS.

Instead of choosing a single route, the ECB opted to blend the three — a decision interpreted by insiders as more political than technical.

Opportunities for alternatives: For financial institutions building tokenized capital markets infrastructure, the 2+ year gap creates an opportunity for other forms of digital money to flourish.

“If the central bank takes too long to deliver its CBDC, banks may be tempted to temporarily turn to stablecoins as an alternative for cross-border and B2B payments, as well as for settling certain tokenized asset transactions onchain,” a senior executive at a Top 5 European bank tells Blockstories.

The big picture: With the notable exception of the U.S., most central banks are now actively shaping the future of financial infrastructure. Just yesterday, the Bank of England laid out its long-term vision: a financial system where tokenized assets, new forms of money, and modern settlement rails coexist with legacy structures.

“It is time to move away from talking about potential and one-off demonstrations […] and start working together to deliver a new generation of the financial system,” said Sasha Mills, Executive Director for Financial Market Infrastructure.

Victoria Jahn is the Head of Regulatory Affairs at 21X, a regulated, blockchain-based exchange operating under the EU’s DLT Pilot Regime.

The ECB’s dual-track strategy is a welcome signal. It shows that central bank money onchain is no longer just a thought experiment. For the first time, all major EU institutions — from the Commission to the ECB — are aligned behind DLT.

But to turn that alignment into real-world progress, it’s essential that all participants have equal access to the proposed solutions, thereby recognizing their individual business models and needs.

In the longer term, interoperability should be a design principle from day one — especially as more institutions experiment with issuing, trading, and settling on public blockchain networks. Such an approach would help central bank money integrate smoothly with the broader digital-asset ecosystem that is already taking shape.

Jonathan Leßmann is the CMO at SWIAT, a blockchain infrastructure provider that played an active role in last year’s ECB trials.

From our perspective, the experimentation phase was a clear success. Many institutions allocated resources. There are three key innovations we see emerging from the ECB’s trial: 1) Intraday repo opportunities (new liquidity management), 2) decentralized DvP (no intermediary) and 3) synchronized liquidity operations (atomic settlement).

The ECB’s two-track approach, with Pontes short-term and Appia long-term, is a smart way to maintain momentum without waiting for a system with all desired features. We consider the open communication and announcement extremely valuable, because this allows the entities to plan and budget within their usual processes.

Central bank money will remain the gold standard for institutional transactions; however, for other use cases other forms of money will have increasing relevance. After this, the next step for digital assets will be ECB eligibility.

TOKENIZATION

Institutions Double Down on Tokenization at Centrifuge’s RWA Summit in Cannes

A flagship event for tokenization: On Tuesday, tokenization platform Centrifuge hosted the latest edition of its flagship Real-World Asset (RWA) Summit at the iconic Palm Beach in Cannes, one of the most anticipated gatherings in the space. The event featured more than 50 speakers from across DeFi and TradFi, including executives from JPMorgan, Apex Group, Chainlink, VanEck, Apollo, and Citi.

An optimistic crowd: The day opened with a live poll: when will the onchain RWA market surpass $1 trillion in AUM, up from today’s ~$270 billion (including stablecoins)? The audience leaned bullish with more than half expecting that milestone by the end of 2026.

What’s driving the shift: Speakers attributed the accelerating momentum to three main forces: regulatory tailwinds, infrastructure maturity, and, most critically, a compelling business case. Unlike past narratives centered on long-term cost savings, the current wave of tokenization offers tangible upside which would make it far easier to win executive buy-in.

“What’s interesting from our TradFi perspective is that we’re now seeing new avenues for distribution, reaching an entirely new class of crypto-native investors,” said Christine Moy, Head of Digital Assets at Apollo Global Management. “It’s very exciting to witness the revolutionary changes in investing, distribution, and borrow/lending which happen to be the three core pillars of our business.”

Blockchain’s superpower: Moy also highlighted blockchain’s most underappreciated strength: the ability to unify disparate asset classes on a single programmable infrastructure.

“Once equities, bonds, commodities, and crypto all live on the same ledger, smart contracts can rebalance them automatically. One day, we’ll each have personalized model portfolios, dynamically optimized in real time.”

Adoption barriers persist: Despite the excitement, many speakers acknowledged that major hurdles remain.

Establishment resistance: Ivan de Lastours, Venture Partner at Bpifrance, voiced skepticism about the political will to embrace public infrastructure.

“We’ve told the Banque de France and the ECB directly: put central bank money on a public blockchain. But changing minds is hard. Just look at the latest BIS report on stablecoins and tokenization. It’s not about innovation, it’s about containment.”

Legacy system integration: Keerthi Moudgal, Head of Product at Kinexys by JPMorgan, emphasized that tokenization must adapt to existing institutional infrastructure.

“Many of our clients are accustomed to interacting with their assets through broker-dealers, order management systems, or execution platforms. At scale, tokenized assets need to plug into those same workflows — especially for risk management and reporting.”

Privacy and identity: Moudgal also pointed to challenges with current identity and privacy models onchain.

“An allowlist alone likely won’t scale. We need more flexible forms of identity — whether through credentials or other mechanisms. And privacy is essential. Investing in a single fund might be fine, but exposing an entire multi-asset strategy on a public ledger is a completely different matter.”

S&P 500 goes onchain: Still, the day’s most symbolic moment came when S&P Dow Jones Indices announced the launch of its first tokenized S&P 500 Index Fund. Built in partnership with Centrifuge, Janus Henderson, and Anemoy Capital, the fund uses official S&P data and Centrifuge’s proof-of-index infrastructure.

“Our collaboration with Centrifuge enables investors to gain direct exposure to the S&P 500 Index, within a blockchain ecosystem that supports liquidity, transparency and interoperability,” said Cameron Drinkwater, Chief Product Officer at S&P Dow Jones Indices. “The potential from here – real-time, programmable, automated and 24/7 indexed portfolio solutions, is incredibly exciting.”

One of the most striking takeaways from the RWA Summit in Cannes was how matter-of-fact the sentiment had become: as a financial institution, of course you’ll (also) need to build on public chains. That’s where global access, scalability, and the fastest pace of innovation are found.

This shift is creating powerful new flywheels: tokenized assets attract more tokenized assets, all benefiting from 24/7 settlement, composability, and programmability. You can see the beginnings with Apollo, VanEck, Janus Henderson, and others bringing their fund products onchain and actively engaging with crypto-native capital.

But there’s still a gap. Asset managers are leaning into DeFi. Banks still seem less interested. The RWA Summit made that visible, too: investor-heavy rooms, few banks, and near-total absence of European institutions. When the value proposition is global distribution, asset managers have the edge. Banks, with their focus on regulatory boundaries and balance sheet control, are moving on a different timeline.

BNP Paribas: Operational Risk Officer - Digital Assets, Lisbon 🇵🇹

Bunq: Head of Growth: Crypto & Stocks, Amsterdam 🇳🇱

Citi: Digital Asset Product Director, London 🇬🇧

Coinbase: Head of Operations, Luxembourg 🇱🇺

Ripple: Client Solutions Director, Enterprise, Geneva🇨🇭 / London 🇬🇧

Taurus: Trading Sales & Distribution Executive, Geneva🇨🇭 / Lausanne🇨🇭 / Zurich🇨🇭

Thunes: Product Lead - Digital Assets, Paris 🇫🇷 / London 🇬🇧

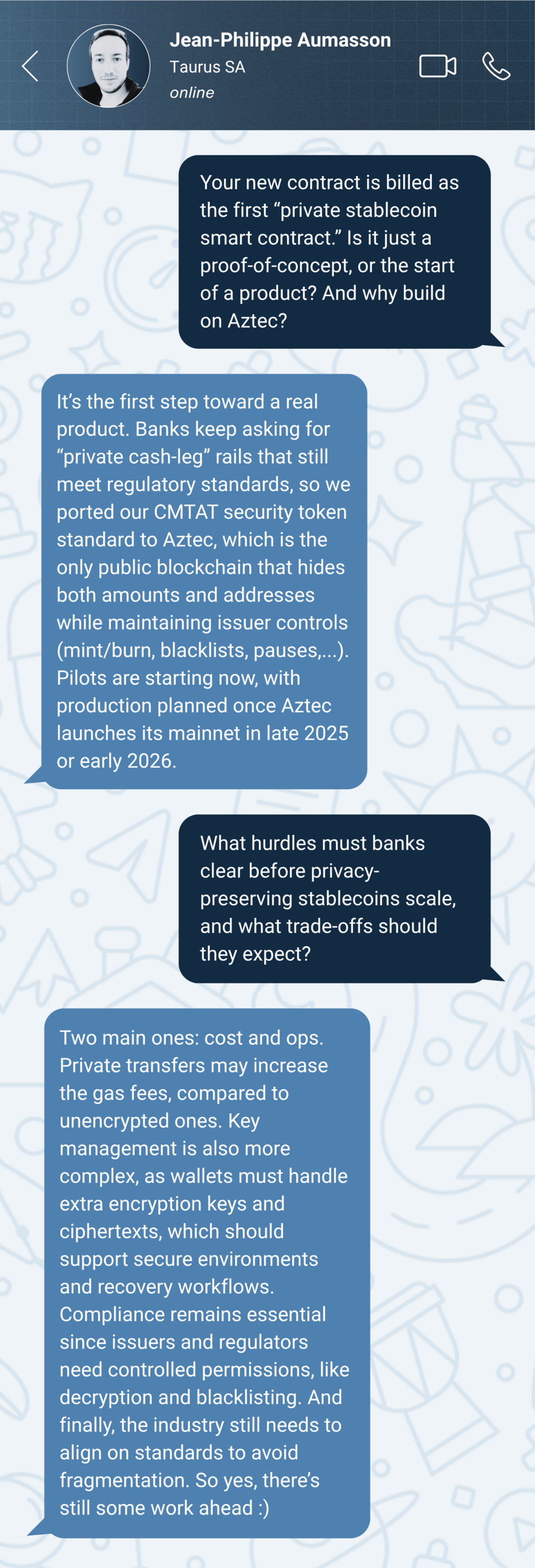

A conversation with Jean-Philippe Aumasson, Co-Founder and Chief Security Officer at Taurus. Last week, Taurus deployed a private stablecoin smart contract on Aztec Network offering confidentiality, untraceability, and anonymity.

Asset Tokenization: The Arrival of a Transformative Trillion-Dollar Industry (Michael Juul Rugaard) — A practical book for professionals looking to understand where tokenization is actually taking hold. Covers the history, regulatory landscape, and which asset types are viable,

Exploratory Work on Wholesale Central Bank Money Settlement (ECB) — The ECB published findings from its May–Nov 2024 exploratory program involving 64 participants and ~€1.6 billion in real DLT‑settled transactions.

How The IMF Prevents Global Bitcoin Adoption (Bitcoin Magazine) — A deep dive into how the IMF has pressured multiple countries to abandon Bitcoin strategies. Author Daniel Batten traces recurring patterns across sovereign crypto efforts and unpacks the geopolitical and financial motives behind the pushback.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.