Visa has been shouting for over a year that “every financial institution needs a stablecoin strategy.” And if you needed any further proof, this week they made clear just how serious they are — by launching what’s essentially the McKinsey for stablecoins.

Called the “Stablecoins Advisory Practice”, Visa’s new consulting service is already helping clients like Navy Federal Credit Union, VyStar, and Pathward map out and implement their stablecoin strategies.

And since Visa also runs infrastructure that lets clients mint, burn, and move stablecoins, it’s safe to assume the business case goes well beyond billable hours.

Today, we’ll also talk about:

DTCC announces pilot on Canton Network

State Street joins push into tokenized liquidity products

Visa rolls out stablecoin settlement in USDC

Today’s edition marks our final Institutional Briefing of 2025. Thank you for spending part of your week with our research throughout the year. We’ll be back in the first week of January, with a few surprises in store. Wishing you a Merry Christmas and a restful end to the year.

HIGH SIGNAL NEWS

JPMorgan launches a tokenized money market fund on Ethereum. Branded “My OnChain Net Yield Fund” (MONY), the fund will be accessible to qualified investors. It offers daily dividend reinvestment, and investors will be able to subscribe and redeem using cash or stablecoins through Morgan Money®, the bank’s trading and analytics platform for liquidity management. 🪙

Standard Chartered and Coinbase expand their partnership. After already enabling real-time SGD (Singapore dollar) transfers for Coinbase customers, the bank will now work with the exchange to explore the development of digital asset trading, prime services, custody, staking, and lending solutions for institutional clients. 🏦

Moody’s releases a proposed methodology for rating stablecoins. Open for comment from market participants until January 26, the methodology positions stablecoins as credit instruments rather than digital assets. 🪙

The UK plans to introduce crypto-asset regulation in 2027. On Monday, the government confirmed that crypto-asset activities will fall under UK financial services law, with detailed rules to be set by the Financial Conduct Authority, giving firms a clear transition period before full compliance is required. 🇬🇧

FDIC issues proposed stablecoin rulemaking for the GENIUS Act. By publishing this draft, one of the main U.S. banking regulators aims to clarify the rules under which banks would be allowed to issue stablecoins. 🇺🇸

→ For a real-time feed of high signal news, visit our News Aggregator.

TOKENIZATION

DTCC Announces Pilot on Canton Network Following SEC No Action Letter

Green light: Last week, the Depository Trust & Clearing Corporation (DTCC) received a No Action Letter from the U.S. Securities and Exchange Commission. The relief allows DTCC to run a three-year pilot of a blockchain-based post-trade layer, while keeping its core clearing, settlement, and risk-management infrastructure firmly offchain.

Why it matters: DTCC sits at the centre of U.S. capital markets. It safeguards more than $100 trillion in assets and processes over $3.7 quadrillion in securities transactions each year. Because virtually every major exchange and broker relies on its infrastructure, even incremental changes to how DTCC operates can carry system-wide implications.

“Recently, we have seen many market participants move to tokenize different asset classes,” explained Frank La Salla, CEO of DTCC, to CNBC. “If the industry moves in a fragmented way, it could hurt liquidity by splitting assets across systems. Given our unique position in the market, we believe it was time to begin tokenization at the foundational level.”

Non-native tokenization: Rather than tokenizing securities themselves, the No Action Letter permits DTCC to issue tokenized entitlements. These digital instruments mirror economic rights and ownership attributes while leaving the underlying securities in traditional custody, preserving existing legal finality and market structure.

Bridging onchain and offchain: To make this model work in practice, DTCC will rely on ComposerX, the tokenization platform developed after its 2023 acquisition of Securrency. ComposerX provides the operational layer for issuance and lifecycle management, while continuously reconciling onchain activity with DTCC’s existing offchain records.

Controlled transfers: Within this architecture, approved participants will be able to transfer tokenized entitlements directly between one another, without submitting settlement instructions to DTCC and potentially outside standard operating hours. To limit both operational and regulatory risk, all activity takes place in a permissioned environment with known counterparties.

Settlement kept offchain: That caution extends to settlement itself. Delivery-versus-payment will not involve stablecoins or tokenized deposits at this stage. Instead, final settlement remains offchain, underscoring that the pilot is designed to test operational flows and interoperability, not to replace DTCC’s core settlement function.

Starting point: Although the No Action Letter covers a broad universe of eligible securities, including large-cap equities, the initial pilot will focus on U.S. Treasury securities, with the first minimum viable product planned for the first half of 2026 on the Canton Network.

Already tested: That choice reflects prior experimentation. In August, a working group including Bank of America and Société Générale successfully exchanged onchain representations of U.S. Treasuries custodied at DTCC against USDC, achieving atomic settlement outside traditional market hours.

Outlook: Over the three-year pilot, DTCC plans to expand gradually into additional asset classes and use cases. While the firm has indicated a long-term ambition to support both permissioned and permissionless blockchains, any step beyond the current scope of the No Action Letter would require fresh SEC approval, keeping the experiment deliberately constrained.

Gabriel Otte is co-founder of Dinari, a U.S.-based provider of tokenized public securities, which was the first to secure a U.S. broker-dealer license for tokenized stocks back in August.

The No Action Letter allows the DTCC to explore tokenization of existing holdings within the current legal framework, where the traditional book entry system continues to provide the trust and system-wide assurance that markets rely on.

I anticipate a careful and phased launch that focuses on operational testing, risk controls, and participant onboarding. Broad tokenization cannot happen unless it fits into the systems institutions already rely on for netting, reconciliation, reporting, and regulated custody.

This regulatory approval is an important unlock for institutions looking to interact with tokenized securities more broadly. The technology for tokenization already works, and this step helps usher in a future where tokenization is not a parallel ecosystem but a core part of post-trade infrastructure.

TOKENIZATION

State Street Joins Tokenized Money Market Push With SWEEP Fund

SWEEP launch: Last week, State Street announced plans to launch its first tokenized product, SWEEP, a tokenized “private liquidity fund” designed for institutional onchain investors. The initial deployment is expected on the Solana blockchain in early 2026, with expansions to Ethereum and the Stellar Network planned thereafter.

Why it matters: With roughly $5.4 trillion in assets under custody and management, State Street is one of the world's largest custodians and asset managers. Its move into tokenized liquidity products follows a path already taken by peers such as BlackRock, Fidelity, WisdomTree, Amundi, and more recently JPMorgan, all of which have introduced onchain money market-style funds to serve crypto-native capital.

Reaching new clients: That momentum is grounded in market traction. Tokenized money market funds now hold close to $9 billion in total value, demonstrating their ability to attract stablecoin issuers, protocol treasuries, and onchain investment funds. For traditional asset managers, these products open access to a growing investor base that sits largely outside their conventional distribution channels.

Crypto-native partnership: To reach that audience, State Street is partnering with Galaxy, which will provide and operate the tokenization infrastructure for SWEEP. Ondo Finance will act as the anchor investor, seeding the fund with an initial $200 million allocation and helping establish early onchain liquidity.

Interview: While detailed operational mechanics and points of differentiation versus existing tokenized funds have not yet been disclosed, State Street is framing SWEEP as a long-term strategic entry into onchain liquidity markets.

We spoke with Kim Hochfeld, Global Head of Cash at State Street Investment Management, about the big opportunity in tokenized money market funds beyond attracting crypto-native capital, and what to expect from State Street’s broader tokenization efforts heading into 2026.

__________________

On the endgame for tokenized money market funds:

“The multi-trillion-dollar opportunity for tokenized money market funds lies in traditional collateral management.

My background is running State Street Investment Management’s traditional cash business, and what originally drew me to this space was the potential for regulated, tokenized money funds to transform how collateral is managed. Putting a tokenized wrapper around a money fund would introduce mobility and near-continuous movement, which is critical for effective collateral and balance-sheet management.

We’ve seen very clearly what happens when that mobility doesn’t exist. During the UK LDI crisis in 2022, institutions had cash sitting in money market funds that they urgently needed for collateral. Accessing that cash required redeeming fund units, a process that took 12, 24, sometimes even 36 hours, and in doing so amplified systemic stress.

If those money fund units had been tokenized, institutions could have transferred the units themselves directly from collateral pledger to collateral receiver, without redeeming the underlying assets. That would have materially reduced liquidity pressure and systemic risk.

This is why regulators globally are increasingly interested in tokenized money market funds. They enable more efficient collateral management, faster capital velocity, and allow institutions to operate with less idle cash on their balance sheets. That, in my view, is the true killer use case.”

On what to expect from State Street in 2026:

“We have an ambitious pipeline of tokenized products planned for 2026 and beyond.

Our longer-term thesis is shaped by a multi-decade wealth transfer and a shift in how assets are held and managed. We expect an increasing share of capital to move from traditional brokerage and custody accounts into digital wallets.

Tokenization allows us to maintain the regulatory protections of traditional asset management while adding the mobility and utility needed for that future, enabling products to operate wherever investors choose to transact.”

BlackRock: Financial Crime Associate – Digital Assets & Tokenisation, Dublin 🇮🇪

BNY: VP - Digital Assets Product Strategy & Commercialisation, London 🇬🇧

ECB: Programme Manager, Wholesale CBDC, Frankfurt 🇩🇪

JPMorgan: Kinexys Digital Assets - Commercial Product Director – Executive Director, London 🇬🇧

Revolut: Business Risk Manager (Crypto), Cyprus 🇨🇾

Ripple: Policy Manager, Luxembourg 🇱🇺

Sygnum: Team Lead - DLT Opportunities, Zurich 🇦🇹

What's the news?

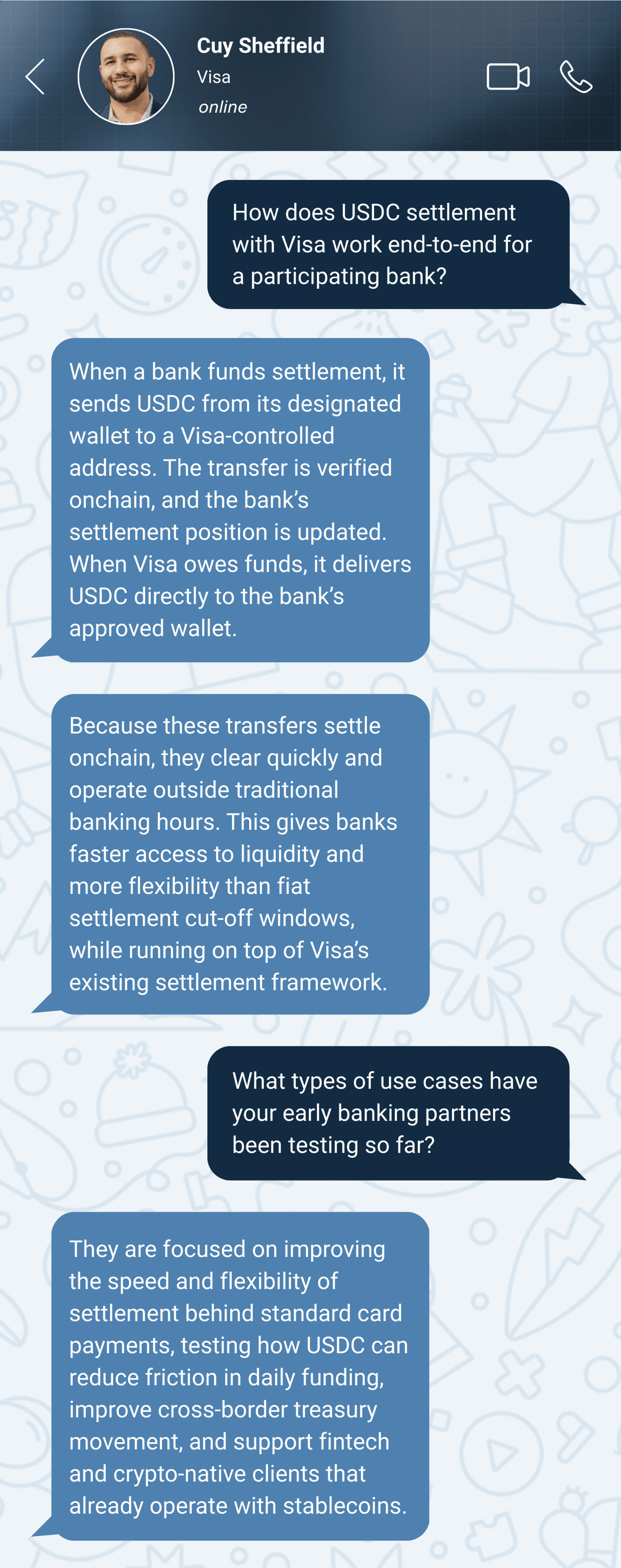

On Tuesday, Visa announced an expansion of its stablecoin settlement pilot. It introduced stablecoin-based settlement in the U.S., enabling U.S. issuer and acquirer partners to settle with Visa using Circle’s USDC.

Initial banking participants include Cross River Bank and Lead Bank, which have started settling with Visa in USDC over the Solana network. Broader availability in the U.S. is planned through 2026.

Why it matters: We spoke with Cuy Sheffield, Head of Crypto at Visa, on how the settlement process works end-to-end and what types of use cases early banking partners have been testing so far.

Stablecoin Ramps & the Cost Bottleneck (Bluechip) — A report explaining how fiat on- and off-ramps, rather than blockchains themselves, are the main constraint on stablecoin adoption, with costs, licensing fragmentation, and UX quality shaping real-world scale.

Are Crypto Ecosystems (De)centralizing? (MIT) — A paper introducing a framework to track how decentralization evolves across crypto ecosystems over time, showing that while systems tend to decentralize as they mature, key layers still exhibit recurring centralization.

State of Crypto Q4 2025 (Coinbase) — A quarterly report outlining trends in crypto adoption and usage, highlighting differences across age groups, investment behavior, and asset allocation, and documenting how crypto is increasingly integrated into broader financial portfolios.

→ Want more? Visit Blockstories Library for a curated selection of 120+ reports on digital assets.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.