👋 Welcome to the first edition of the Institutional Briefing!

Each Thursday, we’ll break down the most important shifts in tokenization, stablecoins, and the institutional adoption of digital assets — so you can stay informed and ahead of the curve.

If we may ask: As we celebrate our debut today, we’d love your feedback. There’s a one-question survey at the end — quick for you, invaluable for us.

In today’s edition:

Citi partners with SDX to tokenize private equities

Deutsche Börse expands into crypto spot trading

Banque de France turns to Ethereum

Coinbase launches new standard for internet payments

NEWS FLASH

Tokenization

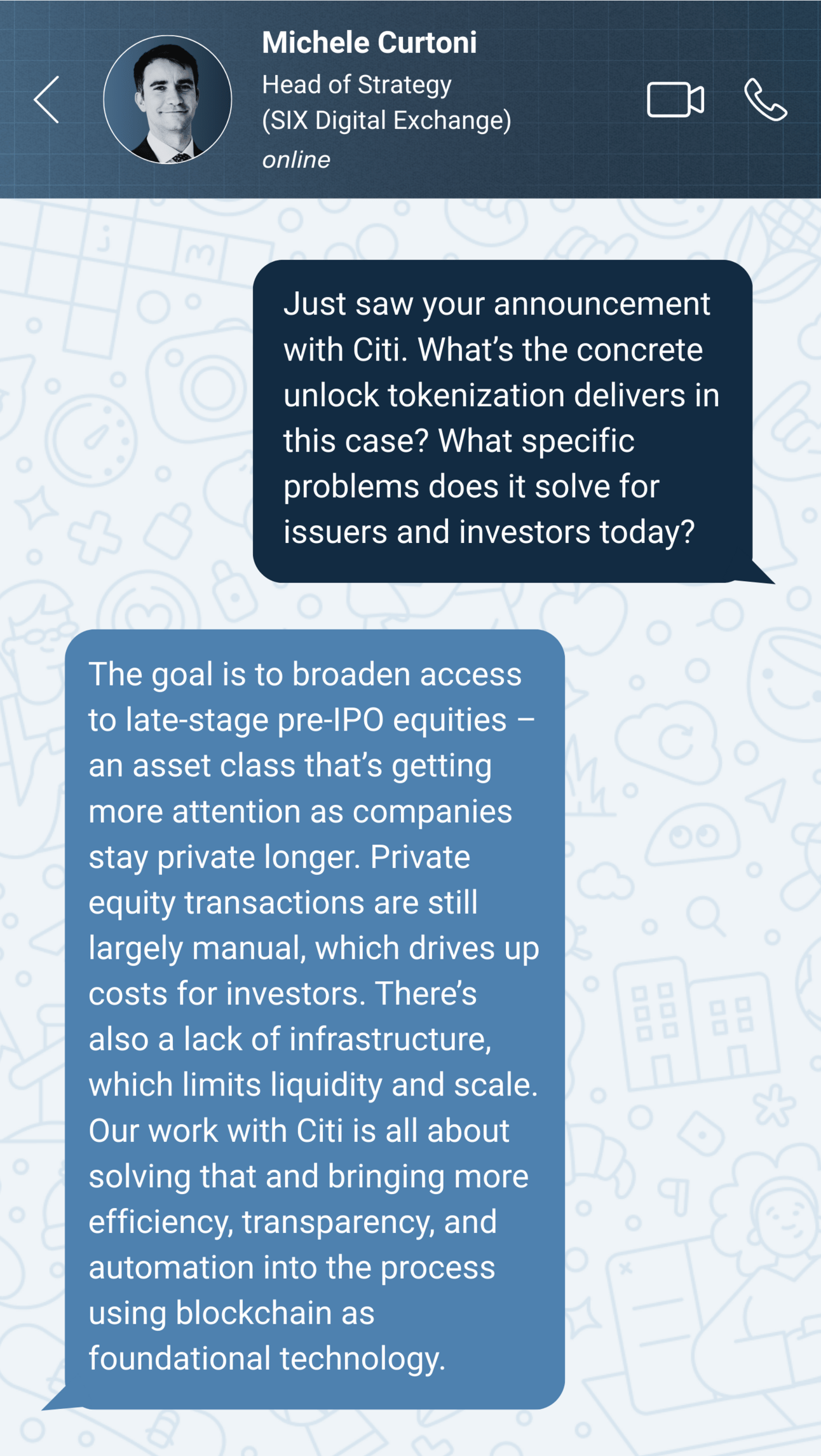

Citi partners with SDX to tokenize private equities. The third-largest U.S. bank will act as custodian and tokenization agent for late-stage and pre-IPO shares via Switzerland’s SIX Digital Exchange (SDX), with the platform set to go live in Q3 2025. (more details below).🇨🇭

SEC announces agenda, panelists for roundtable on tokenization. The U.S. securities regulator will host a roundtable on May 12 titled “Tokenization — Moving Assets Onchain: Where TradFi and DeFi Meet”. Participants include BlackRock, Franklin Templeton, Securitize, and Robinhood.🗣️

Robinhood plans blockchain to trade US assets in Europe. According to a Bloomberg report, Robinhood is developing a blockchain-based platform to offer tokenized U.S. equities to retail investors in Europe. The firm is considering partnerships with Arbitrum or Solana.⛓️

Stablecoins & CBDC

Visa backs stablecoin infrastructure provider BVNK. Visa Ventures has invested in BVNK, a global stablecoin platform serving clients like Ferrari and Rapyd. The move follows BVNK’s $50M Series B round in December.💰

ECB collaborates with private sector on digital euro innovation. Around 70 banks, fintechs, and merchants will test payment features and explore new use cases, with results due later this year.🇪🇺

Custodia and Vantage trial tokenized cross-border payments. Using Custodia’s Avit token on Ethereum, courier firm DX Xpress settled a U.S.–Mexico transaction with programmable, delivery-based payouts.🏦

Regulation

First Draft of U.S. Crypto Market Structure Bill Unveiled. On Monday, a draft bill in the U.S. House of Representatives was unveiled in the form of a discussion document that would, for the first time, establish a regulatory framework for cryptocurrency, clarifying the roles of the CFTC and the SEC.🧑⚖

INSTITUTIONAL ADOPTION

Deutsche Börse Expands into Crypto Spot Trading with 3DX

New trading venue: Deutsche Börse yesterday unveiled 3DX, a new crypto spot trading venue tailored exclusively to institutional clients. Operated by 360T — the group's FX trading subsidiary — 3DX debuts with support for multiple crypto-assets, including Bitcoin (BTC), Ether (ETH) and Solana (SOL).

Key Highlights:

Built on existing FX rails: At its core, 3DX extends the infrastructure of 360T, one of Europe’s largest institutional FX platforms. More than 2,000 corporates and financial institutions use 360T daily to trade spot, forwards, and swaps. This same infrastructure now supports crypto.

Streaming prices over order books: Rather than relying on a central order book, 3DX facilitates bilateral trading through executable streaming price feeds from selected counterparties, enabling tailored pricing and lower slippage.

T+1 settlement, no pre-funding: Trades settle on a T+1 basis, eliminating the need to post capital in advance — a key departure from many crypto-native venues, where pre-funding remains standard.

MiCAR-compliant, BaFin-regulated: 3DX is among the first crypto trading venues to launch under Europe’s new MiCAR regime. The platform is fully operated in Germany and registered with BaFin.

“Horizon 2026”: As a strategic pillar of Deutsche Börse’s Horizon 2026 roadmap, 3DX reflects the group’s broader ambition to digitize asset classes and consolidate trading, settlement, and custody across crypto-assets and tokenized securities into a seamless, integrated infrastructure.

Crypto-assets: After acquiring Crypto Finance in 2021 and launching crypto derivatives on Eurex, 3DX now adds crypto spot trading with more assets and additional services in the pipeline.

Tokenized securities: With Clearstream’s D7, which allows for same-day issuance and settlement of dematerialized securities, and 360X, a marketplace for tokenized alternative assets, Deutsche Börse has already begun shifting traditional instruments onto digital rails.

What’s next: The first institutional clients are expected to go live in the coming weeks, with additional tokens already under review. Deutsche Börse is also in discussions with prime brokers, market makers, and crypto-native liquidity providers. Over time, 3DX is expected to evolve into a modular platform — with additional features like risk management, clearing mechanisms, and alternative settlement options under consideration.

TradFi meets crypto but strictly on TradFi’s terms. No pre-funding, no Telegram chats, no pseudonymous counterparties. 3DX brings familiar workflows into a new asset class, so for banks and corporates it’s just another price feed — Bitcoin sits beside USD/CHF and EUR/JPY.

And that’s precisely the unlock: for the 2,000+ institutions already on 360T, entering crypto becomes operationally trivial. But whether 3DX can rival offshore venues will come down to one thing: liquidity. That’s why all eyes now turn to who joins the venue next.

TOKENIZATION

Banque de France is Showing the Way to Permissionless Blockchains

Ethereum demo: At the Point Zero Forum in Zurich, the Banque de France demonstrated a full end-to-end settlement of tokenized securities on Ethereum — executed entirely on-chain using a MetaMask wallet on the Sepolia testnet.

Collaboration with Singapore: The prototype is part of the Global Layer 1 (GL1) initiative led by the Monetary Authority of Singapore, with support from the ECB, IMF, and the Banque de France. The joint aim: prove that public blockchains can satisfy institutional compliance requirements.

GL1 in action: The system is powered by Ethereum-based smart contracts that enable regulated institutions to exchange tokenized assets under strict compliance constraints. Designed as a public-permissioned network, it combines the openness of public infrastructure with controlled access for KYC-verified participants.

This is how the demo worked:

A participant connects a pre‑whitelisted wallet.

The tokenised asset is wrapped in a contract that runs AML / sanctions checks.

After validation, the asset is unwrapped and delivered to the counterparty.

Open source: According to our information, the Banque de France plans to release their smart contract code as early as next week. The goal is to seed a new technical standard for institutions looking to transact on public chains and accelerate adoption through reuse and collaboration.

A pioneer: The demo is the latest in a long line of blockchain initiatives from the Banque de France. Since 2020, the French central bank has run over a dozen wholesale CBDC pilots, including Project Jura (PvP FX with the SNB) and the DL3S interoperability trials for the Eurosystem.

A couple of years ago the mantra was “permissioned or nothing.” Today a G7 central bank is running MetaMask on stage. That pivot — from closed DLT pilots to public Ethereum rails — is the clearest signal to emerge from Point Zero.

“The message we want to convey through this demonstration is that it is possible for financial institutions to build products in a compliant manner on permissionless blockchains like Ethereum, which have proven their resilience in terms of consensus and offer superior interoperability,” Khay Uy Pham, cross-border wholesale CBDC lead at the Banque de France, told me after the demonstration.

To be clear, this doesn’t solve everything. Privacy, in particular, remains unresolved. But strategically, the shift is hard to ignore. Liquidity, developer talent, and standards are consolidating on public Layer 1s. If Banque de France is proposing to build there, it’s not hard to imagine who’s next.

JOB BOARD

BlackRock: Director Digital Assets, London 🇬🇧

BNP Paribas: Product Manager Digital Assets, Warsaw 🇵🇱

Fireblocks: Sales Director, London 🇬🇧

Revolut: Strategy & Operations Manager (Crypto), Remote 🌐

Santander: Project Manager Digital Assets & Crypto, Madrid 🇪🇸

Standard Chartered: Product Manager Digital Assets, Luxembourg 🇱🇺

Sygnum: Senior Strategic Project Manager (CEO Office), Zurich 🇨🇭

Wintermute: Business Development & Partnerships Manager, London 🇬🇧

Coinbase unveils x402 whitepaper — A new internet-native money protocol that lets agents pay with stablecoins over HTTP.

Stablecoins get a nod from the U.S. Treasury — But the report skips the hard questions on deposits, interest, and dollar dominance.

J.P. Morgan and MIT rethink payment tokens — A new report proposes compliance-ready standards for bank-issued tokens on public blockchains.

YOUR FEEDBACK

Which of the following best reflects your experience with this inaugural Institutional Briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.