It feels like the bitcoin spot ETF moment all over again. BlackRock’s tokenized money market fund, BUIDL, just landed on Uniswap, marking its first appearance on a decentralized exchange.

While trading is still limited to qualified purchasers ($5+ million in assets), infrastructure provider Securitize hinted that retail access may be coming. For now, it’s a test run, stress-testing the future rails for 24/7 settlement between stablecoins and yield-bearing traditional assets.

And if history is any guide, BlackRock’s entry might once again mark the moment others follow. Career risk now certainly feels heavily reduced.

Today, we take you behind the scenes of:

Boerse Stuttgart settles first confidential tokenized security transaction on Ethereum

BBVA joins the European banking consortium Qivalis

HIGH SIGNAL NEWS

Crédit Agricole joins the FARO banking consortium. Announced in early October, the initiative explores issuing 1:1 reserve-backed digital money, focused on G7 currencies. Existing members of the consortium already include Citi, Deutsche Bank, Bank of America, Santander, and BNP Paribas. 🌍️

London Stock Exchange partners with Apex Group on private funds. The fund administrator will become the first provider connected to DMI, the DLT platform of the financial market infrastructure group. The service is expected to go live in H1 2026. 🇬🇧

ICE integrates Polymarket. The NYSE operator has added Polymarket to its Signals & Sentiment suite, giving clients access to prediction market data and analytics. ICE invested $2 billion in Polymarket in October. 🇺🇸

Deutsche Börse integrates the xStocks tokenized equity standard. Via its regulated tokenization venue 360X, clients will access the xStocks 1:1-backed tokenized equity standard, developed by Backed Finance and recently acquired by Kraken. 🇩🇪

Aviva Investors partners with Ripple to tokenize funds. The £246bn asset manager will issue tokenized funds on the XRP Ledger, marking its first move into tokenization and Ripple’s first European asset manager partnership. ⛓

ONCHAIN PRIVACY

Boerse Stuttgart Settles First Confidential Tokenized Security Transaction on Ethereum

Pioneer transaction: Last week, Boerse Stuttgart Group announced that it completed the first confidential delivery-versus-payment (DvP) transactions of tokenized securities on a public blockchain. The settlement was processed through its DLT platform, Seturion, while the transaction itself was executed on Aztec, a privacy-focused layer-2 network built on Ethereum.

Why it matters: Unlike previous tokenized DvP tests, the transaction data, including counterparties, amounts, and execution logic, was not visible on the public chain. Instead, only a cryptographic proof confirming that all settlement conditions were met was recorded on Ethereum.

“This transaction shows that confidentiality does not require moving to a closed, permissioned network, which limits access to open innovation, create interoperability barriers and as such reduce network effects. We can embed privacy at the protocol level while still settling on public Ethereum,” explained Samuel Bisig, CTO at Seturion, to Blockstories.

Inside the transactions: With wholesale CBDC and stablecoin adoption still evolving, Boerse Stuttgart tested two DvP models, one using traditional payment rails for the cash leg and one using onchain cash.

Selective disclosure: In both models, only the buyer and seller were able to see their own balances and transaction details. The public blockchain just recorded encrypted entries and a proof that the rules were followed, while regulators can access additional information if required.

Visualization of both workflows: escrow-based DvP and atomic DvP

Research phase: As of now, the transactions were executed as a technical proof of concept rather than a live production rollout, aimed at exploring how confidential settlement could function on public infrastructure.

__________________

Industry perspectives: To provide more context, we spoke with the two actors involved and asked another key market participant for their assessment on where onchain privacy stands today.

Samuel Bisig is the Chief Technical Officer at Seturion, the DLT settlement platform of Boerse Stuttgart Group. The platform builds on infrastructure first deployed in Switzerland, where the group’s subsidiary BX Digital operates a FINMA-regulated DLT trading venue using it as its settlement layer. Now applying for an EU DLT Pilot Regime license, Boerse Stuttgart is extending this proven model into the European market.

Why did you choose Aztec over other privacy solutions?

When evaluating privacy solutions, our focus was on whether they could realistically support securities settlement in a regulated market environment. We looked at permissioned network approaches, which can provide confidentiality but require participants to operate within closed networks and specific governance models. For us, this raised questions around interoperability and how such systems could connect to broader market infrastructure.

While we are evaluating various approaches that add privacy, we especially see added value in “programmable privacy” directly on the protocol level, rather than just on the data level (potentially even adding further centralization vectors like sequencers, security councils, permission committees). The protocol-inherent separation of private and public execution and state in Aztec allows us to keep everything private and confidential by default, while allowing special third parties like a regulator to access the data with auditability.

Looking ahead, scaling this approach will depend on how privacy-preserving networks like Aztec mature in practice. That includes their ability to operate reliably over time, how they scale under load, how they integrate with institutional custody and key management setups, as well as the general development of standardized security token frameworks.

Arnaud Schenk serves as Executive Director of the Aztec Foundation, which oversees the development of the Aztec Network, a privacy-centric Ethereum Layer 2 infrastructure.

How can settlement be public, but the transaction remain private?

Instead of sending transaction details directly to a public blockchain, the transaction logic is executed in a privacy-preserving execution environment, in this case Aztec, where all rules, checks, and conditions are evaluated confidentially before any proof is published. This includes relevant business logic and, where applicable, compliance requirements. The public blockchain only receives a cryptographic proof and never sees the underlying transaction data or how the transaction was executed.

What is recorded on the blockchain is simply a cryptographic proof confirming that the rules were followed correctly. Neither the public network nor the validators verifying the transaction have access to the underlying information: they only check the validity of the proof and update an encrypted state, without visibility into users, amounts, counterparties, or execution logic.

Regulators and other authorized parties can be granted access to the underlying transaction information when legally required, without making that data public. This allows institutions to combine confidentiality for market participants with effective regulatory oversight, while still relying on public blockchain infrastructure for settlement and finality.

Daniel Coheur joined Apex Group as Global Head of Digital Assets following the fund administrator’s acquisition of Tokeny, the Luxembourg-based tokenization platform he co-founded. With its Apex Digital 3.0 platform and its work around the ERC-3643 standard, Apex Group is making a big push into tokenization.

Where do investors and issuers stand on onchain privacy today?

From our perspective working with asset managers and fund issuers, demand for onchain privacy is clearly increasing. There is broad agreement that sensitive investor data, such as personal identity, eligibility documentation, and detailed cap table information, should not appear on public blockchains. In most institutional structures, that information remains offchain with regulated intermediaries.

The open question is transaction-level confidentiality. As tokenized securities move into DvP settlement and collateral use cases, attention shifts to what becomes visible in trading and settlement flows.

Transfer amounts, counterparty exposure, and position movements are commercially sensitive and often balance-sheet relevant. Test transactions like the one executed by Seturion matter because they demonstrate how settlement can evolve without exposing that information.

Apex Group: Product Lead - Tokenised Funds and SPVs, Madrid 🇪🇸

DRW: Quantitative Trader Crypto, London 🇬🇧

EBA: MICA Senior Supervision Expert, Frankfurt 🇩🇪

Fireblocks: Business Development Manager, London 🇬🇧

OKX: Sr. Business Development Manager (VIPs), Remote 🇩🇪

Stripe: Product Counsel, Crypto and Money Movement Legal, Dublin 🇮🇪

Swift: Digital Assets Strategy Lead, Madrid 🇪🇸

Tether: Blockchain Manager, Europe 🇪🇺

What’s the news?

Last week, BBVA officially joined Qivalis, the European consortium aiming to launch a euro-denominated stablecoin in the second half of 2026. The initiative now brings together 12 banks, including BNP Paribas, ING, DekaBank, and UniCredit.

This comes as a mild surprise, as Spain’s second-largest bank had initially planned to issue its own stablecoin using Visa’s issuance platform, as detailed by Francisco Maroto, the bank’s Head of Digital Assets, in an interview with Blockstories last August.

BBVA is one of the most advanced European banks in the market when it comes to digital assets, having offered custody and crypto trading services to both retail and institutional clients since this summer.

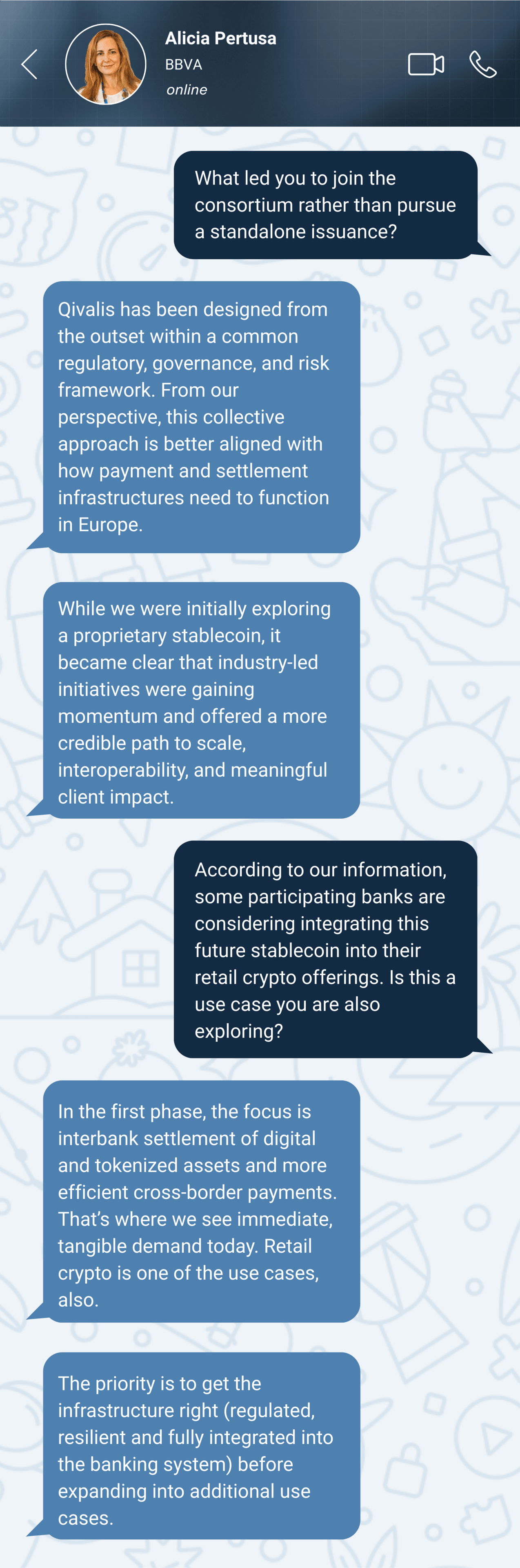

Behind the scenes: We spoke with Alicia Pertusa, Head of Partnerships and Innovation at BBVA CIB, about the rationale behind joining a consortium rather than issuing independently, and the use cases they are targeting for their clients.

Analyzing the Rise of Tokenized Equities (Sentora & DL Research) — A report reviewing market structure, protocol-level metrics, chain distribution, and regulatory developments shaping the expansion of tokenized equities, with growing positioning for institutional DeFi allocation.

Stablecoins vs. Tokenized Deposits (New York Fed) — A study examining how reserve-backed stablecoins and bank-issued tokenized deposits affect interest rates, credit creation, and welfare, revisiting the narrow banking debate in a blockchain context.

The Hidden Plumbing of Stablecoins (MIT) — A paper examining the financial, technological, and regulatory dependencies underpinning dollar stablecoins, highlighting how liquidity, intermediaries, and blockchain infrastructure shape their stability as the market scales.

→ Want more? Visit Blockstories Library for a curated selection of 120+ reports on digital assets.

What do you think of today's briefing?

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.