The recent crypto M&A wave has now reached institutional shores. This week, Apex Group snapped up Tokeny, a Luxembourg-based tokenization platform.

Despite recent chatter around leadership shakeups in its digital assets unit, Apex is doubling down. It’s also backing 21X, the only active venue under the EU’s DLT Pilot Regime. Their first tokenized product went live on Tuesday.

Interesting to see the building blocks of tokenization coming together. More on that below.

Here’s what else we’re covering today:

Bitstamp secures MiCA license

U.S. Senate advances stablecoin bill

Deutsche Börse sets stage for electronic shares

Forwarded this email? Subscribe here for more.

NEWS FLASH

Regulation

Trade Republic secures MiCA license. The German neobank is now licensed under MiCA to offer crypto custody, trading, and transfers — approved by BaFin.✅

Hong Kong passes Stablecoin Bill, effective later this year. Issuers will need a license from the HKMA — marking the city’s first formal framework for fiat-pegged stablecoins.🇭🇰

Bitstamp obtains MiCA license. The exchange platform has obtained its Crypto Asset Service Provider (CASP) license from the CSSF, Luxembourg’s financial regulator. This allows Bitstamp to passport its services across the entire European Economic Area.✅

Tokenization

Apex Group acquires tokenization platform Tokeny. The fund administrator has bought a majority stake in Luxembourg-based Tokeny, a leading tokenization platform. This move follows Apex's initial investment in Tokeny in late 2023 and aims to integrate Tokeny's technology and team into Apex's services.💰

BX Digital unveils five trading partners for Swiss DLT exchange. Sygnum, Incore, Hypothekarbank Lenzburg, ISP Group, and EUWAX AG join BX Digital’s Ethereum-based trading venue ahead of launch. The platform offers direct settlement under Switzerland’s DLT regulation.🇨🇭

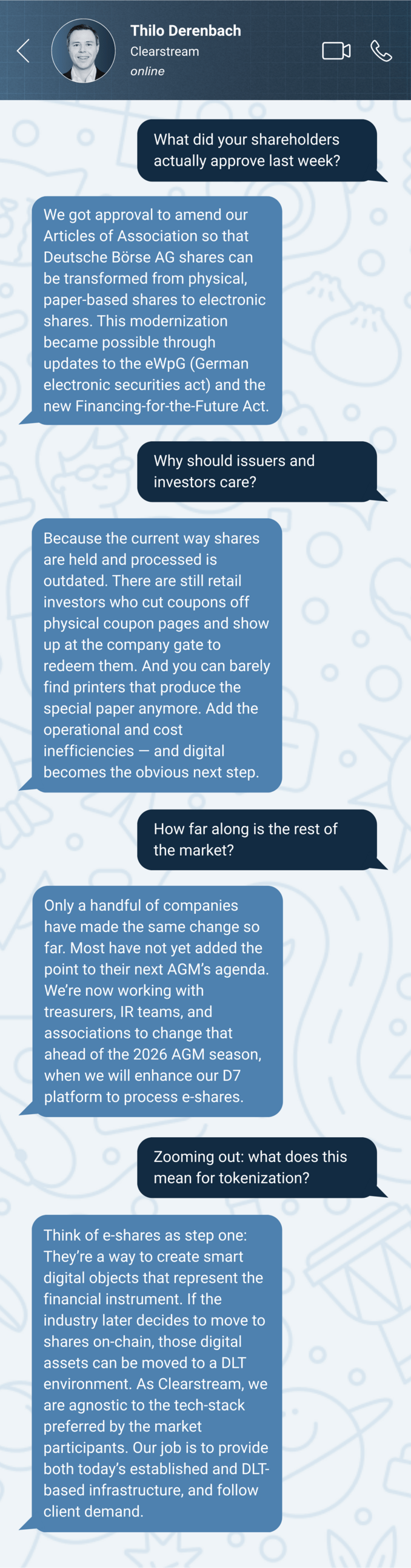

Deutsche Börse shareholders vote in favor of share digitization. With this vote, Deutsche Börse shares can now be converted from existing paper-based documents into electronic entries. Scroll down for our Proof of Talk with Clearstream’s Thilo Derenbach, where he breaks down what the shareholder vote really changes and how it fits into the bigger tokenization picture.🗳️

Investment

JP Morgan to allow clients to buy Bitcoin. “We are going to allow you to buy it, and we’re not going to custody it”, said JP Morgan CEO Jamie Dimon about Bitcoin during the bank’s annual investor day on Monday.💵

TOKENIZATION

21X becomes first DLT trading venue live under EU Pilot Regime

Live under Pilot Regime: Frankfurt-based 21X has gone live under the EU’s DLT Pilot Regime. On Tuesday, the exchange opened primary issuance for its first product — USMO (US Money-Black Manta USD Short Term Yield).

Why it matters This marks the first time a regulated market infrastructure has gone live under the EU’s DLT Pilot Regime — a temporary framework enabling the trading and settlement of tokenized financial instruments without a central securities depository (CSD).

End-to-end onchain: Unlike most tokenization pilots, which operate in closed environments or bilateral setups, 21X is licensed as a DLT trading and settlement system — combining matching, custody, and post-trade settlement on public blockchain infrastructure (Polygon). Transactions are settled atomically using MiCA-regulated euro and dollar stablecoins.

Investor access: While the DLT Pilot Regime permits direct retail participation, 21X does currently not plan to engage individual investors directly.

“In addition to institutional investors, we’re currently focused on order-flow providers such as neobanks and retail-facing brokers”, said Marc Hegen, CTO of 21X, in our conversation. “We’ll reach the mass market through our partners”.

First listing: The first asset listed on 21X is USMO — a tokenized short-term note issued by Black Manta Capital Partners and economically linked to a UBS USD money market fund. The product is currently limited to primary issuance and redemption through the platform, with secondary trading expected to follow at a later stage.

Ecosystem build-out: Ahead of launch, 21X partnered with Apex Group — one of the world’s largest fund administrators — to act as the first official listing sponsor on its platform. Last week, the German startup also announced the integration with MiCA-regulated stablecoins EURQ and USDQ from Quantoz Payments, issued via Tether’s Hadron platform. Support for USDC is expected to follow.

What’s next: The venue is following a staged rollout. Secondary market trading is expected to launch in the coming months, with additional issuances already in preparation.

“We’re not only interested in traditional products, but also in natively tokenized funds”, said Marc Hegen, CTO of 21X. “We’re seeing strong interest in tokenized ETFs”.

21X is building what looks like a DeFi protocol — but with full regulatory approval. That’s what makes it interesting: a public blockchain venue that’s accessible to institutions under existing EU law. Still, the hard part starts now.

To succeed, 21X needs to attract real liquidity on both sides of the market and show it can offer products that investors actually want. One asset manager we spoke to put it plainly: “The tokenization of a note, backed by a money market fund, is less attractive to traditional investors, since unlike fund units, notes don’t qualify as segregated assets. Direct fund tokenization would be the stronger model”.

With Marc Hegen hinting at “natively tokenized funds” to come, we’ll be watching the next listings closely.

The emergence of trading venues operating with blockchain-based settlement infrastructure like 21X is an interesting signal for the adoption of this technology by traditional institutional players.

But for the DLT Pilot Regime to thrive, Europe needs to provide a level-playing field compared to traditional markets by allowing the listing of products with more than €500 million in assets under management. As long as this limit exists, it’s not attractive for issuers like us to deploy one of our money market funds on this type of infrastructure. Recently, regulators in France and Italy have proposed lifting this cap. I hope that proposal moves forward.

Paul-Adrien Hyppolite is the co-founder and CEO of Spiko, a Paris-based company that brings money market funds onchain and manages over €260 million in tokenized cash assets.

REGULATION

U.S. Senate Advances GENIUS Act: Stablecoin Bill Moves Into Final Debate

Milestone vote: On Tuesday, the U.S. Senate approved a procedural vote on the GENIUS Act — a legal framework for stablecoins — with 66 votes in favor, 32 against, and two abstentions. The turnaround comes just eleven days after an earlier procedural attempt failed to reach 60 votes.

Why it matters: The GENIUS Act aims to establish a legal regulatory framework for stablecoins used as payment instruments in the United States. It also serves as a starting point for broader legislation on crypto market infrastructure.

What’s in the bill:

Issuers: Stablecoins can be issued by banks, fintechs, or commercial firms, provided they register with the appropriate federal regulator. If issued by banks, the stablecoins won’t be included in the consolidated capital requirements.

Reserves: Stablecoins must be 100% backed by cash, Treasury repos, or short-term government securities.

Regulatory thresholds: Issuers with over $10 billion in circulation fall under federal oversight; those below may operate under qualifying state regimes.

Foreign issuers: Must register with the OCC, maintain sufficient reserves at U.S. banks to meet redemptions, and be able to freeze transactions when legally required.

Yield restrictions: Stablecoins may not pay interest or offer yield to holders.

New changes: The revised bill introduces several adjustments — most notably concerning non-financial public companies like Meta, Amazon, and Google — and includes a provision barring senior public officials from issuing stablecoins while in office, in a broader move to limit undue influence in digital finance.

“Big Tech was a focal point in the negotiations leading up to Monday’s vote, which resulted in the inclusion of stricter issuer registration standards for non-financial public companies”, Salah Ghazzal of the Blockchain Association told us.

Free ride for Trump: Not all Democratic objections were addressed — the final bill leaves the President and Vice President exempt from the stablecoin ban, allowing initiatives like Liberty Financial’s USD1, linked to the Trump family, to proceed unchecked.

Next steps: Topics like these will now return to the spotlight as the bill enters the amendment phase. Yesterday, the Senate approved a motion to proceed with formal debate on the GENIUS Act, triggering a process where further revisions are expected. Once the bill passes a final Senate vote, it will need to be reconciled with the House’s existing stablecoin proposal — the Stable Act — before it can reach the President’s desk and become law.

Blocking yield-sharing doesn’t protect consumers — it protects incumbents. Today’s banks capture the bulk of yield on customer funds and distribute it upstream to shareholders and executives. Just take a look at this chart. That gap isn’t an accident. It’s a design feature.

Stablecoins, by contrast, have the potential to flatten that margin, delivering some of it downstream to users, platforms, or protocols. Cutting off that mechanism doesn’t make the system safer. It just ensures the public continues to underwrite returns that accrue elsewhere — to institutional investors (via tokenized MMFs) or offshore users (via unregulated stablecoins).

Let’s hope this gets a second look during the amendment process.

While the GENIUS Act mirrors MiCA in several respects, the U.S. bill is widely viewed in its current form as more issuer-friendly. MiCA, by comparison, takes a more prescriptive approach — requiring “significant” stablecoin issuers to hold 30% to 60% of their reserves in commercial bank deposits.

By allowing reserves to be held in higher-yielding instruments like Treasuries, the GENIUS Act preserves issuer economics and avoids the unintended consequence of concentrating run risk on commercial banks during periods of large-scale redemptions.

JOB BOARD

BBVA: Digital Assets Specialist, Madrid 🇪🇸

BNP Paribas: Digital Asset Product Manager, Warsaw 🇵🇱

bunq: Product Owner Crypto, Amsterdam 🇳🇱

Fidelity Digital Assets, Ltd.: Chief Compliance Officer, London 🇬🇧

Fireblocks: Associate General Counsel, Zurich 🇨🇭

GK8 by Galaxy: VP Sales, London 🇬🇧

Revolut: Global Head of Crypto Expansion, Remote 🌍

A chat with Thilo Derenbach, Head of Sales & Business Development Digital Securities Services at Clearstream, following Deutsche Börse’s shareholder vote to enable the issuance of electronic shares.

Tokenization report by WEF — In a new report, the World Economic Forum is exploring how ledger technology (DLT) and tokenization can transform financial markets.

Visa’s stablecoin report — Visa is exploring different stablecoin use cases and opportunities for banks.

Robinhood’s tokenization letter to the SEC — It calls for a unified national framework and proposes that tokens representing assets should be legally equivalent to the underlying asset.

Disclaimer: The information provided in the Institutional Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.